By Brian Finkelmeyer, Senior Director, New Car Solutions, vAuto

There’s an interesting game of roulette being played in the new car business right now, with about half of the dealers betting on red and the other half betting on black.

The wagered bet is whether dealers should continue taking additional new vehicle inventory into stock.

Many dealers have understandably been unnerved by this pandemic and have voluntarily placed themselves on finance hold to halt any additional vehicles from being delivered. Most OEMs have tried to combat this fear by offering additional wholesale incentives or by providing deferred floorplan terms.

A recent inventory analysis at vAuto uncovered that 60% fewer new vehicles were delivered to dealership lots the first week of April 2020 vs. the same week a year ago. There’s a fair amount of pessimism at the inventory roulette wheel.

But I’ve spoken with more optimistic dealers who’ve expressed good reasoning for why they will continue taking new vehicle deliveries, despite the gloomy economic outlook.

Let’s take a closer look at the two differing perspectives on this topic and try to understand which group is making the wiser bet.

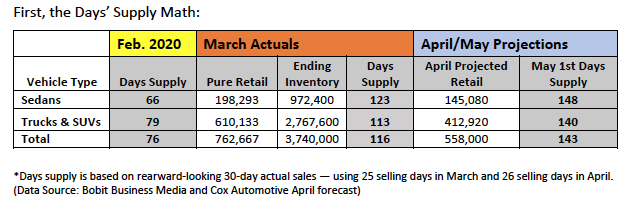

The Pure Retail New Car SAAR dropped from 13.4M in Feb to 8.7M in March. Ouch. This drove the days supply numbers 53% higher to 116 days.

Cox Automotive forecasts retail sales to be down 55% in April, which is better news than the original estimates, which were in the 75–80% range. This revised sales forecast would put the Pure Retail SAAR at 5.7M for the month of April.

The April sales forecast puts retail sales volume at 558,000 units for the month. If we apply this sales volume to the ending March inventories – we can see that the industry days’ supply will climb from 94 days to 143 days. That’s a significant increase. However, that equates to about a five-month supply of inventory on dealer’s lots. Based on this math, it’s easy to understand why some dealers are betting on “red” or against taking additional new vehicle inventory.

Now, let’s look at the reasons why the more bullish dealers continue to place their chips down on black — taking more inventory. Consider the following:

1. OEM production has essentially halted globally, and it will likely take 6 months before normal production and inventory volumes begin flowing again. What dealers have on their lots today is likely what they will have to sell from for the next four to six months. Based on the math above, most dealers will need what they have on the ground just to get through this downturn in manufacturing.

2. The auto industry is simply “too big to fail.” There are strong indications that the government will launch another “cash for clunkers”-type program to spur demand sometime this summer, once there is more certainty around the health crisis. Morgan Stanley auto analyst, Adam Jonas, is reporting the new program would be in the $10B range vs. the 2009 “cash for clunkers,” which was $3B.

3. Unlike with used cars, new car dealers have a motivated partner in their OEM to help drive demand. The domestic makes have already shown a willingness to become aggressive with programs like 0% APR financing for 84 months. In March, the average incentive spend was 10.5% of Average Transaction Price — which is higher than in any of the past five years. According to the latest Cox Automotive 2020 COVID-19 Impact Study, one-third of shoppers are delaying their vehicle purchase, however, almost half of those could spur into action if they find the right deal.

4. Necessity vs. Emotional Purchases. Dealers tell me that about 50% of their new car sales are “necessity” purchases — lease turn-ins, life-changing events, totaled vehicles, etc. Demand for “necessity” purchases will continue — some of which are likely being postponed until summer.

5. The financial cost of holding new vehicle inventory is quite low — as interest rates have plummeted.

6. Cash flow – new car deliveries bring with them holdback, floor plan, ad assistance dollars, and pre-delivery inspection money for the technicians. Dealers are conscious of their cash on-hand, and new car deliveries do create more cash.

This economic downturn has a massive impact on consumer demand and their ability to buy new vehicles. As a consequence, dealer days’ supply at most stores has more than doubled since February, which has certainly raised some eyebrows and caution around the inventory roulette wheel.

However, with 2020 being an election year, there will be huge political motivation to get the economy and the American consumer back on track. The potential Cash for Clunkers II program could drive nearly 4M units of sales volume. The OEMs will have more concern about their cash flow and less focus on margins—which means bigger consumer incentives. All of these elements combined could create some big winners at the inventory roulette wheel.

Last week, a dealer friend from North Carolina told me, “Dealers are optimists by nature and we always find a way to figure it out.”

If I were placing my bet at the new vehicle inventory roulette wheel, I’d bet with the optimists on black because I believe in three things: the American consumer’s resilience, American politicians’ willingness to spend money, and the American car dealer’s ability to always figure it out.

ARTICLE BY Brian Finkelmeyer

Brian Finkelmeyer is senior director of new car solutions at vAuto, having spend more than 15 years on the OEMS side of the industry.