WESTLAKE VILLAGE, Calif. — December’s new-vehicle retail selling rate remains robust near the close of 2012, with potential buyers unfazed by the current level of economic uncertainty generated by the fiscal cliff negotiations in Washington, D.C., according to a monthly sales forecast developed by J.D. Power and Associates’ Power Information Network® (PIN) and LMC Automotive.

Retail Light-Vehicle Sales

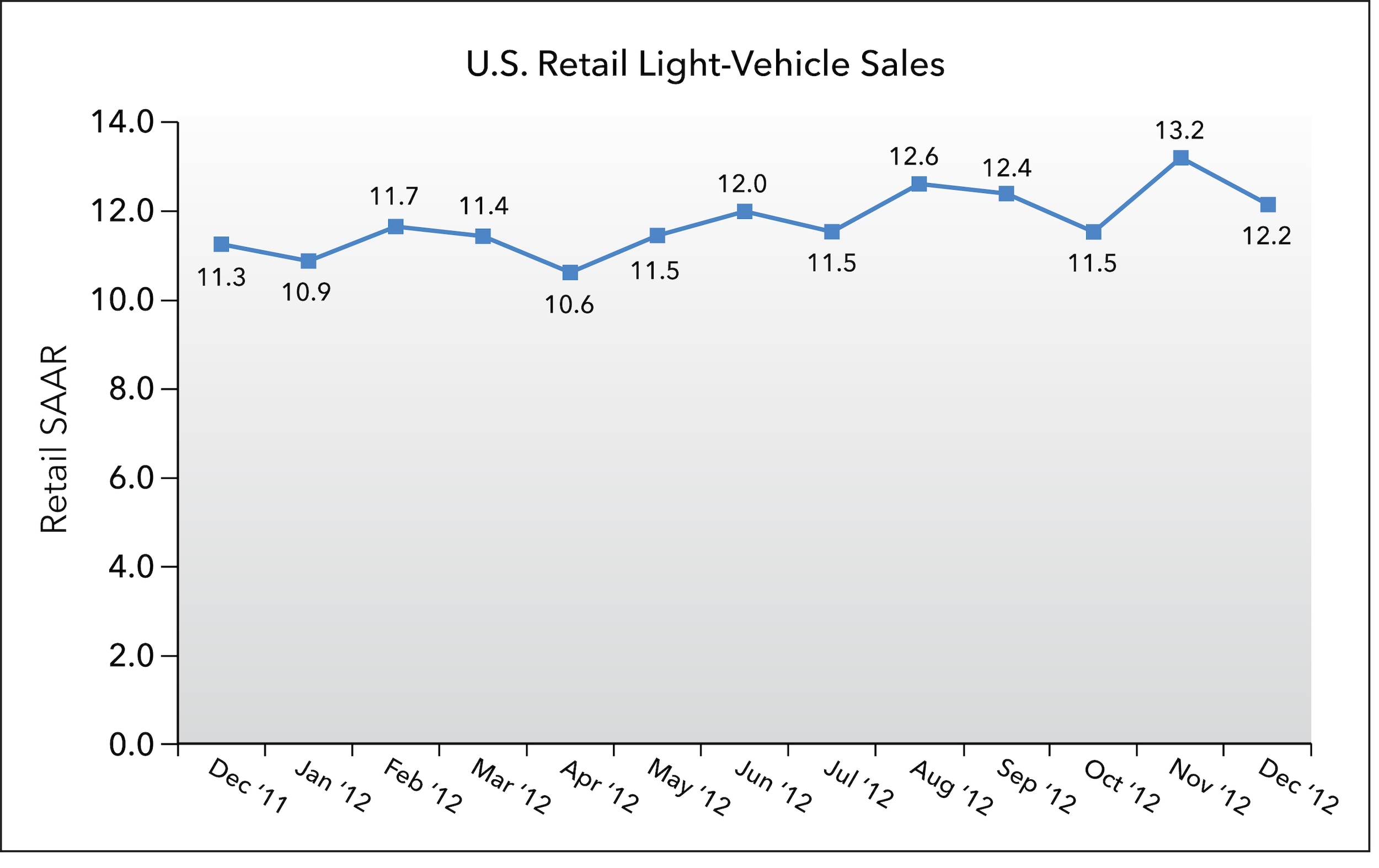

December new-vehicle retail sales are expected to come in at 1,152,500 units, which represent a seasonally adjusted annualized rate (SAAR) of 12.2 million units. December’s selling rate remains strong and is 500,000 units higher than the expected 2012 full-year rate. Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles.

Luxury-vehicle sales are on pace to account for 16.0 percent of all retail vehicles sold in December, an increase from 15.3 percent in November 2012 and 14.8 percent in December 2011. Luxury share in December is the highest in 2012 and the highest since December 2009, when it reached 16.2 percent.

“Luxury sales always do well this time of the year, but December is turning out to be a great month,” said John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates. “New and re-designed vehicle introductions, along with enhanced incentive activity, have been key drivers of the recovery in the luxury market.”

(in millions of units)

Total Light-Vehicle Sales

Total light-vehicle sales in December 2012 are projected to increase 14 percent from December 2011, with volume at 1,358,600 units. Fleet mix is expected to reach 15 percent, which is consistent with a managed supply and demand market, and is the sixth consecutive month below 20 percent.

J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons

| December 20121 |

November 2012 |

December 2011 |

|

| New-Vehicle Retail Sales | 1,152,500 units2(15% higher than December 2011) | 953,449 units | 1,040,035 units |

| Total Vehicle Sales | 1,358,600 units(14% higher than December 2011) | 1,141,696 units | 1,240,263 units |

| Retail SAAR | 12.2 million units | 13.2 million units | 11.3 million units |

| Total SAAR | 15.3 million units | 15.4 million units | 13.5 million units |

| 1 | Figures cited for December 2012 are forecasted based on the first 13 selling days of the month. |

| 2 | The percentage change is adjusted based on the number of selling days in the month (26 days in December 2012 vs. 27 days in December 2011). |

Sales Outlook

Based on strong sales in November and early December, LMC Automotive is edging up its 2012 forecast for total light-vehicle sales in the United States to 14.5 million units from 14.4 million units and maintaining the forecast for retail sales at 11.7 million units. The forecast for 2013 remains 15 million units for total light-vehicles and 12.2 million for retail sales, but represents a slower growth rate of four percent from 2012.

“The U.S. light-vehicle sales market continues to be a bright spot in the tremulous global environment,” said Jeff Schuster , senior vice president of forecasting at LMC Automotive. “The only major roadblock ahead for the U.S. market is the fiscal cliff. Assuming that hurdle is cleared, 2013 is one step closer to a stable and sustainable growth rate for autos, with volume above the 15 million unit mark.”

North American Production

Light-vehicle production in North America is up 19 percent through November 2012, compared with the same period in 2011. Volume with one month remaining in 2012 is nearly 14.4 million units, an increase of 2.3 million units, compared with 2011.

Vehicle inventory in early December fell below the 70-day level—to a 69-day supply, compared with 71 days in November. The supply reduction is a result of the strong sales pace in November bouncing back from the impact of Hurricane Sandy at the end of October. Car inventory is steady with a 65-day supply, down slightly from 66 days in November, while truck inventory has decreased to a 72-day supply from 77 days. Vehicle inventory levels should stabilize even further this month and into early 2013 with automakers’ scheduled holiday production shutdowns in late December and the expected robust sales pace in the month.

As 2012 draws to a close, LMC Automotive projects the 2012 North American production forecast to finish with nearly 15.4 million units produced, a 17 percent increase from 2011. For 2013, the North American production forecast is expected to reach 15.8 million units, a modest three percent rise from 2012, with further upside potential contingent on the pace of demand in the first half of 2013.

About J.D. Power and Associates

Headquartered in Westlake Village, Calif., J.D. Power and Associates is a global marketing information services company providing performance improvement, social media and customer satisfaction insights and solutions. The company’s quality and satisfaction measurements are based on responses from millions of consumers annually. For more information on car reviews and ratings, car insurance, health insurance, cell phone ratings, and more, please visit JDPower.com. J.D. Power and Associates is a business unit of The McGraw-Hill Companies.

About The McGraw-Hill Companies

McGraw-Hill announced on September 12, 2011, its intention to separate into two public companies: McGraw-Hill Financial, a leading provider of content and analytics to global financial markets, and McGraw-Hill Education, a leading education company focused on digital learning and education services worldwide. McGraw-Hill Financial’s leading brands include Standard & Poor’s Ratings Services, S&P Capital IQ, S&P Indices, Platts energy information services and J.D. Power and Associates. With sales of $6.2 billion in 2011, the Corporation has approximately 23,000 employees across more than 280 offices in 40 countries. Additional information is available at http://www.mcgraw-hill.com/.

About LMC Automotive

LMC Automotive, formerly J.D. Power Automotive Forecasting, is the premier supplier of automotive forecasts and intelligence to an extensive client base of automotive manufacturer, component supplier, logistics and distribution companies, as well as financial and government institutions around the world. LMC’s global forecasting services encompass automotive sales, production and powertrain expertise, as well as advisory capability. LMC Automotive has offices in the United States, the UK, Germany, China and Thailand and is part of the Oxford, UK-based LMC group, the global leader in economic and business consultancy for the agribusiness sector. For more information please visit www.lmc-auto.com.

Media Relations Contacts

John Tews ; Troy, Mich.; (248) 680-6218; [email protected]

Emmie Littlejohn ; LMC Automotive; Troy, Mich.; (248) 817-2100; [email protected]

No advertising or other promotional use can be made of the information in this release without the express prior written consent of J.D. Power and Associates or LMC Automotive. www.jdpower.com/corporate www.lmc-auto.com

SOURCE J.D. Power and Associates