Crossovers/SUVs While Still in Demand Experienced Higher Declines Last Week

Welcome to this week’s edition of Black Book Market Insights, with in-depth analysis of used car and truck valuation trends and insights straight from the auction lanes. Click here to download the full report.

This week’s Black Book Market Insights report shows a slight weakening in prices on crossovers and SUVs this past week, even though demand has remained at healthy levels. Conversely, car segments showed a little more retention strength compared to what they’ve shown throughout summer, supported by dealer comments around the country.

“The steeper depreciation seen recently in the car segments slowed last week while the depreciation on crossovers and SUVs accelerated,” said Anil Goyal, Senior Vice President of Automotive Valuation and Analytics.

- Volume weighted, overall car segment values decreased by 0.47% last week, much lower than the depreciation rate of 0.73% seen in the previous three weeks.

- Full-Size Car, Sporty Car and Prestige Luxury Car declined the most by 0.93%, 0.80% and 0.59%, respectively.

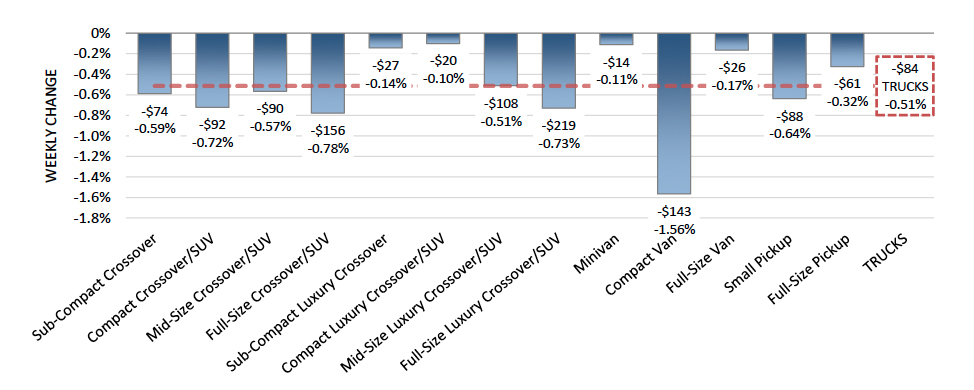

- Volume-weighted, overall truck segment (including pickup, SUVs and vans) values decreased by 0.51% last week. This is higher than the depreciation rate of 0.36% seen in the previous three weeks.

- Compact Van, Full-Size Crossover/SUV, Full-Size Luxury Crossover/SUV and Compact Crossover/SUV segments declined the most by 1.56%, 0.78%, 0.73% and 0.72%, respectively.

Decline of Sub-Compact Car Retention

The chart above shows how the retention rates on a segment can change substantially over time. For 2010 MY, the retention in August 2012 for Sub-Compact Car was 63%. In comparison, for 2014 MY, the retention in August 2016 has dropped to 44%. With the increasing used supply and eroding demand, this segment has experienced a steep decline in retention values.