In our industry today, partnering with professional capital is a significant discussion thread. Namely, selling less than 100% of the business and joining forces with outside capital for the purposes of accelerated growth and dealership acquisitions is becoming more common. This is in contrast to the historical industry norm of an outright sale.

I am aware of an increasing number of these transactions. For example, Todd Blue and the Indigo Auto Group recently announced a significant strategic investment from PON, a multi-billion dollar European automotive conglomerate. Similarly, we have two clients, both with considerable dealership platforms, seeking capital investment in their businesses.

What is driving this interesting dynamic?

Young entrepreneurs, such as Todd Blue, represent the next generation of aggressive growth-oriented dealers who are willing to partner with the right capital source to build out their platforms in the accelerated timeline they desire. Working with an outside capital partner can clearly supercharge a dealer’s growth plans, eliminating the constraints of organic growth.

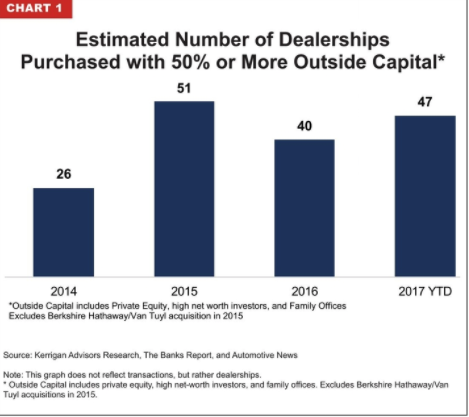

According to our analysis, we estimate there were 40 transactions in 2016 in which the seller sold less than 100% of the business. Since 2014, we estimate this type of non-traditional transaction structure represented 17% of the buy/sell market, a significant shift from prior years.

Chart 1

Estimated Number of Dealerships Which Sold a Minority or Majority Stake

2014 to YTD 2017

Source: Kerrigan Advisors Research, The Banks Report, and Automotive News

Note: This graph does not reflect transactions, but rather dealerships. Outside Capital includes private equity, high net-worth investors, and family offices. Excludes Berkshire Hathaway/Van Tuyl acquisitions in 2015.

We believe that the primary driver of this dynamic is the overall cost of a typical acquisition. Kerrigan Advisors pegs the average dealership value (including blue sky and real estate, but excluding working capital and fixed assets) at $17.0 million! That is no small deal and not one that a dealer can easily acquire without an outside capital source, whether that be debt or equity.

Chart 2

Kerrigan Advisors Estimate of Average Dealership Real Estate and Blue Sky Value

Full Year 2016 versus First Half 2017

Source: NADA and Kerrigan Advisors Analysis

In addition to blue sky and real estate, dealership acquisitions also require significant working capital and the purchase of fixed assets. When all of these elements are added together, the average transaction, for a single dealership, approaches $20 million. And, that is just an average. Many attractive dealerships, by virtue of size or location, are worth considerably more. For a dealer who seeks to acquire a group, transactions can easily enter the “nine-figures” zone.

Although our industry has plenty of well capitalized dealership groups, not all are able or – equally importantly — willing to take on acquisitions of this magnitude. As one dealer explained to me some time ago, “We have bet the family farm multiple times in this industry. And, while we still want to grow, we’re just not willing to continue doing that.”

Considerations

As you consider your own growth plans for your business, a strategic capital partner may be a compelling option. However, it is important to assess whether you are a good candidate for this approach. Below, I have listed six key criteria to consider when determining if a capital partner is an appropriate strategic choice for you and your business.

Professional, metrics-oriented management. Sophisticated financial partners are very metrics driven, and they generally hold managers at all levels to predetermined budgets and rigorous levels of performance. In certain regards, auto retail is a natural fit as our industry also has its share of key metrics, which are religiously tracked, starting with units sold on a daily basis. The plethora of reports provided by the OEMs can be very helpful in tracking the success of a dealership and identifying areas for improvement. That said, we find auto dealers are generally more comfortable with significant monthly swings in performance than are seasoned investors. And, given fluctuations or lagging performance, financial investors may push for staffing and organizational changes much more quickly than dealers are accustomed. If you are considering an outside investor, you may want to assess your internal controls and management style to determine if you are ready for a metrics-based management system.

Willingness to share control, and possibly answer to outside investors. Constitutionally, some business owners are simply more willing than others to collaborate and make decisions in a joint manner. Dealers need to be honest with themselves if they are open to being challenged on a regular basis about the business that they are operating day-to-day, particularly from voices that are not trained in auto retail. It is important to also recognize that many investment funds have a mandate for “control investments.” No matter how they dress up this language, control investors negotiate their documents in a manner that allows them to make unilateral decisions. While they may state their position to “back the management team,” they retain the right to change out management as they see fit, albeit subject to some limitations set forth by OEMs. It is critical to understand investors’ mandates and style. Control investors vs. non-control investors have very different philosophies (out of necessity) in how they interact with management teams, particularly if things do not go as planned.

Clean, professional accounting. Generally accepted accounting principles do not typically drive auto retail accounting. In fact, dealership financial statements employ a variety of accounting methodologies to some degree driven by dealer or controller preference. Unfortunately, accounting variability will simply not be tolerated with outside investors, and will quickly lead to misunderstanding and dysfunction. Only a consistent GAAP accounting method will work for most investors. If external investment is something you are seriously considering, it is important to review your accounting procedures and improve areas where GAAP is not currently employed. Some dealers will need to incur significant expense as it relates to improving financial controls, and overhauling accounting procedures. Dealers may also consider annual audits or financial reviews of the statements in preparation for a capital raise.

No mixture of business and pleasure. Most dealerships are privately owned, and often owned by multiple family members. These businesses are sometimes used as an extension of the family, funding the lifestyle and priorities of the various owners, including cars, boats, charitable giving and other types of non-business expenses. With outside investors, it is important to separate business and pleasure, and business and family. Such a change can make a capital partner unattractive for some dealers and auto retail families.

Willingness to assume the goals and priorities of investors. The prerogatives and needs of investors shift over time. A dealer who takes on a capital partner will need to evolve with their investors to stay in step with investors’ strategic goals. For example, a big uptick in earnings that excites the dealer-operator may prompt an investor to start thinking more seriously about when to sell the business, even accelerating their exit plans by multiple years. Conversely, some tough down years could reverse that logic. It is important to recognize that a dealer is not in a position to make unilateral decisions as it relates to funding growth, expansion and divestiture when investors have a seat at the table.

OEM approval. Finally, any outside investment must be proposed in a manner that will achieve OEM buy-in. There is no clear checklist for this, as OEMs have different prerogatives and varied relationships within their dealer bodies. For example, OEMs that are highly motivated to attain new, expanded facilities or achieve “clusters” of dealerships owned by a single group may be more flexible in the approval process. In other situations, an OEM’s concern about operational control and ability to influence dealers’ strategies may result in skepticism on their part. Core to all OEMs’ evaluation will be whether the partnership dilutes the auto retail experience running the dealership and the OEM retains significant leverage in the relationship. Each situation will be unique, and we suggest framing these proposed partnerships in a manner that OEMs perceive as win-win.

If the criteria set forth above fits with your organization and management style, and you desire to grow your business beyond internally generated cash flow, then seeking investors is a sound strategic option to evaluate. In our experience, some of these criteria are difficult for dealers to accept, and an outright sale is typically a preferential option when the time is right to take chips off the table. That said, we are at an interesting point in the buy/sell market, where dealers and established auto retail families have many choices as it relates to monetizing their dealership assets. As we see it, options are always good, as long as you understand the structure.