Today, there are more buyers seeking acquisitions than there are sellers seeking capital. We are in a classic dealership seller’s market. Based on the data and analysis in The Blue Sky Report™, I expect this seller’s market to last through 2014 and most of 2015, at which point the supply of dealerships for sale will likely begin to increase and buyers will gain pricing power. Until then, I see nothing but blue skies for sellers.

There are three important drivers of today’s buy/sell activity and blue sky pricing, specifically: (i) the health of the auto retail industry; (ii) buyer access to capital; and (iii) the low yield investment environment.

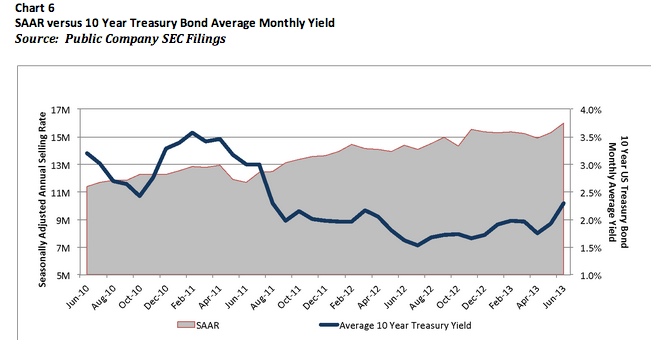

1. The Health of the Auto Retail Industry: Car sales grew 8% in 2013 to 15.5 million new units sold. This growth exceeded our expectations and brought our industry closer to pre-recession sales levels. Interestingly, even though 2013’s sales were still 1.4 million units lower than 2005’s record, the average dealership’s earnings, according to NADA, were up 75% (since 2005) and hit a record $923,248 (see Chart 1 and 2). Strong new vehicle sales growth (three year average: 11%) combined with a 19% reduction in the number of dealerships and significant operational cost cuts have resulted in a highly profitable dealer body. Today, buyers have strong cash flow from operations with which to acquire stores and most sellers are highly attractive due to their growing profits.

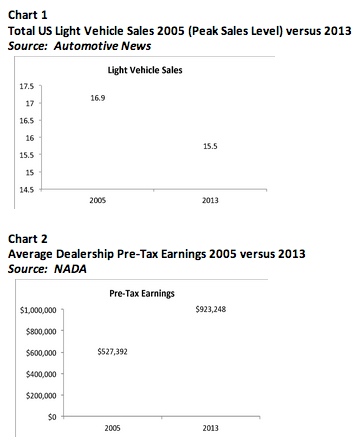

2. Buyer Access to Capital: As a result of our industry’s rebound, dealership buyers now have tremendous access to capital, both from operating cash flow and financing sources. We estimate that the top 125 dealership groups (excluding the publics) have seen their operating income increase by 167% since 2009 to an aggregate annual amount of ~$2.8 billion. Also, as you can see on Chart 3, the public dealership groups have seen their operating income increase to a record $1.6 billion.

In addition to growing cash flow from operations, dealers have increasing access to debt financings on historically attractive terms. Dealership credit quality continues to rise as a result of record profits, growing cash reserves and increasingly valuable collateral, making them very good credit risks. Banks are once again eager to grow their dealership loan portfolios and captive finance companies are becoming more aggressive on buy/sell lending, particularly for well-funded groups. As a result, while the overall commercial and industrial loan market is up 37% since October 2010, Kerrigan Advisors estimates that outstanding dealer loans have grown at a significantly higher pace.

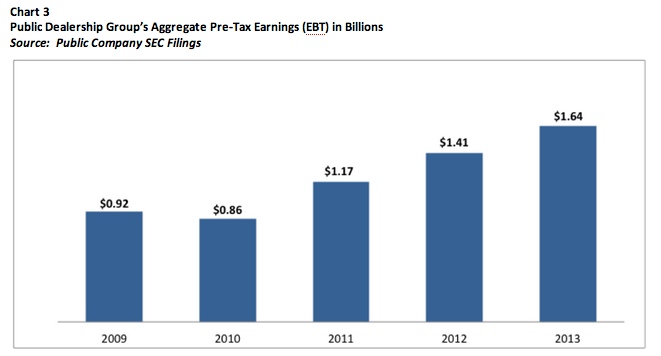

3. Low Yield Investment Environment: Today’s low yield investment environment has resulted in attractive acquisition financing rates and lower acquisition return expectations for buyers. The combination of these two trends is driving higher blue sky pricing. Buyers are increasingly willing to reach to sellers’ pricing expectations because they are able to finance a large portion of the acquisition and thus have lower equity requirements and higher equity return expectations. They are also more willing to pay higher values because dealerships provide a much higher return on investment, even at premium pricing, than what they are currently earning on their ever-increasing cash reserves, which are often invested in floor plan offset accounts. Likewise, sellers are unwilling to part with their dealerships at lower valuations, in part because of the low returns they expect on their liquidity after the sale. For a sale to make sense today, sellers require higher values.

These three trends will likely continue to positively affect buy/sell activity and dealership pricing through 2015; however, buyers and sellers should be aware that as our industry’s sales and earnings growth slows, buy/sell activity and blue sky values will start to decline.

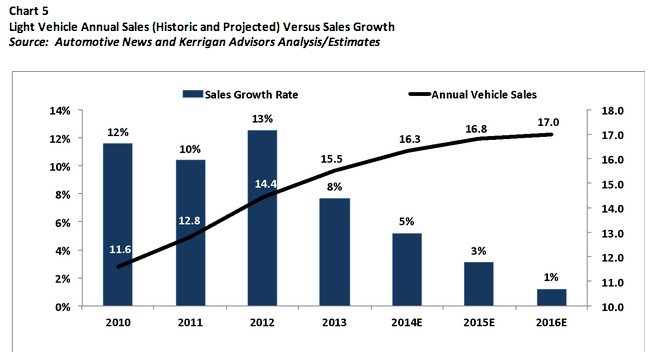

I expect our industry to sell more than 16 million new vehicles in 2014 and remain in that sales range for several years. While a 16 million sales rate sounds great, the reality is our industry’s growth rate is slowing significantly, as you can be seen in Chart 5. I expect to see just 5% growth in 2014 (down from 8% in 2012) and just 3% growth in 2015. How long we remain at these high sales levels is an unknown; however, given the cyclical nature of our industry, it is likely that we will experience a decline in sales within the next 5 years.

As the industry grows at a slower pace and our rebound matures, competition for car sales will heat up. To achieve higher sales goals, manufacturers and dealers will need to take share from one another. Gross profits from new vehicle sales will likely suffer, as we are already starting to see. The public companies’ new vehicle front-end gross profits are currently at a 7-year low and have declined 10% since their peak in 2011. Likewise, NADA dealers reported a 7% decline in new vehicle gross profit in 2013. We are also seeing new vehicle inventory levels rise, which puts further pressure on margins.

Additionally, certain costs, which were slashed during the recession, are starting to return to the dealership expense structure as sales volumes pick up. According to the most recent data from NADA, new-car dealerships had an annual average payroll of $2.9 million in 2012, up 12% from 2011. As old costs come back and new costs (Affordable Care Act) enter the picture, this too will put pressure on future dealership earnings.

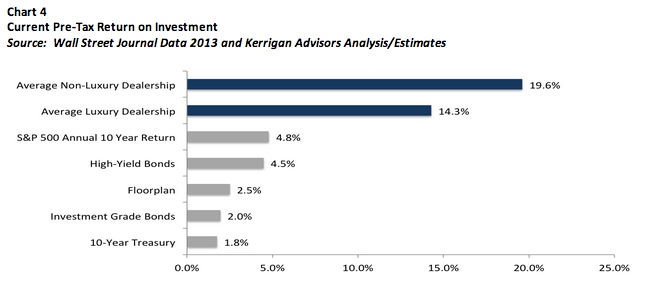

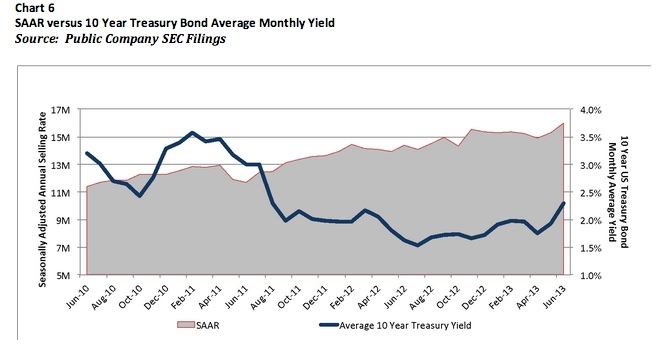

Another potential challenge to future car sales is rising interest rates (they have nowhere to go but up). As can be seen in Chart 6, new vehicle sales, like dealership earnings, are inversely correlated with interest rates. While we do not expect interest rates to increase in the near term, at some point in the future they will increase.

Because borrowing rates have been a major driver in the car sales rebound, an increase in rates will likely have a big impact on U.S. car sales. Also, there is some concern that car owners will increasingly find themselves in negative equity positions in their vehicles, as car loans become longer in order to make car payments affordable, particularly since average household incomes remain low. According to Experian Automotive, the longest-term new-car loans, 73 to 84 months, increased 25% in 2013 and now make up 20% of total new-car lending.

In the future, I expect slower dealership sales and earnings growth will have the single biggest impact on buy/sell activity and blue sky pricing. Pent up buyer demand should absorb the sellers coming to market in the near term, but eventually slower sales and earnings growth will impact buyers’ willingness to make acquisitions and pay premium prices.

Buyers will go from acquisition mode to dealership management mode, as they work to sustain their groups’ sales and earnings growth. It’s human nature. When your business’ earnings growth slows, you don’t feel like splurging on an acquisition. Until that time comes, enjoy today’s positive buy/sell market. Like all good things, it too will come to an end.