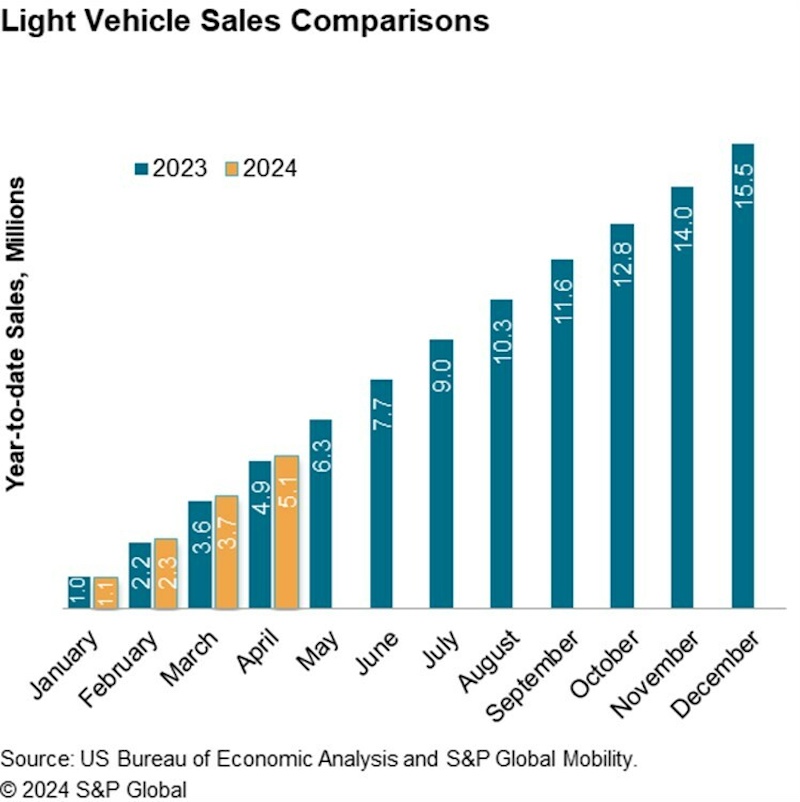

New light vehicle sales volume will hit 1.34 million units in April, according to the latest S&P Global Mobility report releases April 30.

Despite what appears to be a downturn from March 2024 (down 7%) and from April of the previous year (down 2%), adjustments for selling days—two fewer than in March and one less than in April 2023—place the expected figures in a more optimistic light. This calculated volume aligns with an expected sales pace of 16.0 million units, marking it as only the third occurrence in the past 24 months to achieve such a rate, on a seasonally adjusted annual rate (SAAR) basis.

The auto sales environment of late has been a combination of increasing inventory levels and incentives grappling with the deterrents of high-interest rates and elevated vehicle prices, according to Chris Hopson, principal analyst at S&P Global Mobility.

“The anticipated April result reflects that consumers are still in the market for a new vehicle,” commented Hopson.

Inventory Issues

Officials noted current retail inventory figures underscore this trend, increasing 65% from last year to 2.97 million units. This increase of dealer inventories, predominantly composed of 2024 and some 2025 models, has highlighted remaining pockets of older vehicle stocks.

Matt Trommer, associate director at S&P Global Mobility, noted “consumers in the market for a new vehicle are increasingly able to find opportunities for discounts coming from the availability of more vehicles in dealer inventory.”

Looking ahead, the supply dynamics within the automotive industry hint at a sustained growth trajectory for both inventories and incentives throughout 2024. Joe Langley, another associate director at S&P Global Mobility, points to a revised outlook for North American light vehicle production, which predicts a 1.5% increase to 16.0 million units. This adjustment reflects a resilient demand and an optimistic interpretation of supply chain challenges.

EV Forecast

The enticement of new vehicle buyers, who have been hesitant due to economic factors such as interest rates, is seen as a likely outcome of these progressing production levels.

That lead Hopson to warn “It will be a bumpy ride and month-to-month sales volatility is likely.”

The forecast for 2024 envisions a 3% increase in light vehicle sales volume to 16.0 million units. Central to this projection is the expected development of electric vehicle (EV) sales.

Although some short-term volatility is anticipated, the EV market share in April is projected to mirror March’s figures at 7%, with significant growth expected in the subsequent periods. This optimism is bolstered by the scheduled market launches of the Chevrolet Equinox EV, Honda Prologue, and Fiat 500e, alongside advancing sales of Tesla’s Model 3 and Cybertruck.