The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services and is part of the KAR Auction Services family.

The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services and is part of the KAR Auction Services family.

December 2012 Kontos Kommentary

Summary

Some residual effects of Superstorm Sandy may be evident in the relatively strong wholesale prices seen during December, with average prices rising by over three percent relative to November. Moreover, December has been a seasonally stronger month than November and more comparable to January in recent years, notwithstanding, or perhaps because of, the tendency of some consignors to hold cars during December in anticipation of higher prices in January. Those consignors who chose to sell rather than hold in December were rewarded with stronger prices, as well as capitalizing on the time value of money.

Details

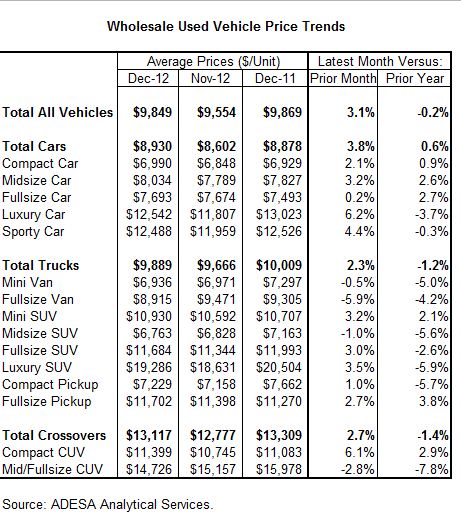

According to ADESA Analytical Services’ monthly analysis of Wholesale Used Vehicle Prices by Vehicle Model Class1, wholesale used vehicle prices in December averaged $9,849 – up 3.1% compared to November and down a modest 0.2% relative to December 2011. Cars, trucks and crossovers all showed strong monthly gains.

Prices for used vehicles remarketed by manufacturers rose by 3.2% month-over-month in December, and were up 6.9% year-over-year, indicating continued good absorption of off-rental program vehicles. Fleet/lease consignors experienced a 2.8% increase in December, resulting in prices being up 2.0% year-over-year. Dealer consignors saw a 3.5% average price increase versus November, leaving prices down 1.7% versus December 2011. For the full year, wholesale prices in 2012 versus 2011 were up 4.9% for manufacturers, but down 0.4% for fleet/lease consignors, and 1.7% for dealers. This is explainable in part by the more significant lack of late-model used vehicles generally sold by manufacturers versus the more abundant supply of older models typically sold by fleet/lease companies and dealers.

Based on data from CNW Marketing/Research, retail used vehicle sales in December were up 16.3% year-over-year for franchised dealers and 18.4% for independent dealers, yielding a total increase of 4.9% month-over-month for both groups combined. For the year, retail used vehicle sales were up 5.0% versus 2011, yielding a total of almost 29 million units sold (broken out by about 15 million franchised dealers and 14 million independent dealers). December sales of certified used vehicles were down a modest 0.7% versus a strong prior year December figure, and up by 5.7% versus prior month based on data from Autodata. Total certified pre-owned (CPO) sales in 2012 broke the 1.8 million annual threshold for the first time.

1The analysis is based on nearly six million annual sales transactions from over 150 of the largest U.S. wholesale auto auctions, including those of ADESA as well as other auction companies. ADESA Analytical Services segregates these transactions to study trends by vehicle model class.

The views and analysis provided herein relate to the vehicle remarketing industry as a whole and may not relate directly to KAR Auction Services, Inc. The views and analysis are not the views of KAR Auction Services, its management or its subsidiaries; and their accuracy is not warranted. The statements contained in this report and statements that the company may make orally in connection with this report that are not historical facts are forward-looking statements. Words such as “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “bode”, “promises”, “likely to” and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The company does not undertake any obligation to update any forward-looking statements.