Anticipating Another Strong Year of Transaction Activity

2018 promises to be a very active year for buy/sells with more private and public buyers eager to put their capital to work. Buyers believe growth is the answer to a changing auto retail environment and are eager to capitalize on economies of scale and scope. Kerrigan Advisors also observes more sellers coming to market in 2018. As more dealers find their succession plan unviable, we expect the number of sellers to rise progressively throughout the year, particularly given the drumbeat of change reverberating throughout the industry. (The drumbeat could not have been louder at the recent NADA convention in Las Vegas.) We also continue to see transaction sizes increasing and multi-dealership groups coming to market at a rising pace.

With this backdrop, we have identified three key market trends that will meaningfully impact the buy/sell market in 2018 and beyond.

- Tax reform benefits auto retail and results in increased buy/sell activity

- Dealers’ investment strategies shaped by auto retail’s expected evolution

- Dealership profit variability widens blue sky pricing ranges

Tax reform benefits auto retail and results in increased buy/sell activity

Auto retailers will be positively impacted by the recent US tax reform. First, most consumers will experience an increase in their after-tax income which will likely ensure continued growth in the US economy and help the auto retail industry maintain a high level of sales for several more years. Second, reduced corporate taxes will increase many of the largest dealers’ after tax-income, more than making up for the industry’s slight decline in pre-tax profits. As such, groups who are looking to grow will have more free cash flow to do so.

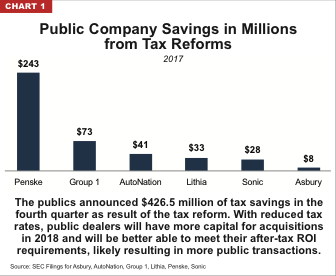

This is particularly true for the publics. Kerrigan Advisors expects the public retailers to be more acquisitive in 2018 in part because of a material increase in their free cash flow. The public auto retailers, all of which are structured as C Corporations, will receive a 40% reduction in their federal tax rate from 35% to 21% in 2018. (See Chart 1) With this change, public companies will not only have the additional cash flow to allocate towards acquisitions, they will also be at a competitive advantage in pricing transactions relative to most private buyers because their after-tax return on investment (before dividends to shareholders) will be higher than the returns most private dealers can achieve. Thus, we may see public acquirers increase their pricing on acquisitions relative to private buyers and ultimately winning more competitive transactions.

“Tax benefits for us should be, generally speaking, better or greater than the tax benefits for the smaller private operators.” – Sean Goodman, CFO, Asbury Automotive. (2017 Fourth Quarter Earnings Call)

“Tax benefits for us should be, generally speaking, better or greater than the tax benefits for the smaller private operators.” – Sean Goodman, CFO, Asbury Automotive. (2017 Fourth Quarter Earnings Call)

“This change in our tax rate lowers the hurdle rate we apply to our acquisitions, resulting in more deals meeting our disciplined annual return on equity target of 15% to 20%.” – Bryan DeBoer,, CEO, Lithia Motors. (2017 Fourth Quarter Earnings Call)

Dealers’ investment strategies shaped by auto retail’s expected evolution

There is no doubt the way in which new vehicles are sold and the kinds of vehicles sold will change dramatically in the future. While these changes will have implications for the auto retail business model as we know it, the timing of the transformation is still very much an unknown. As such, these factors are not currently being priced into today’s franchise values because the market is unclear how they will affect future profits.

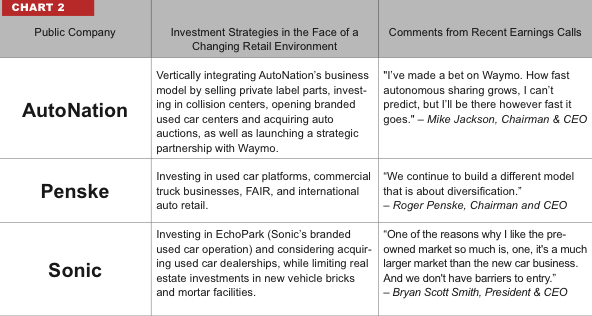

This being said, some of the largest dealership groups in the industry are adjusting their investment strategies in anticipation of change. For instance, private dealership groups, such as Holman Automotive and Flow Automotive, are actively investing in fleet management operations, anticipating shifts in consumer car ownership. Likewise, three of six publics are allocating some of their investment capital to diversify their business model away from new vehicle sales. These companies expect their diversification strategies will better position them for any potential disruption to the current auto retail business model and provide opportunities to capitalize on a changing environment. (See Chart 2)

As the evolution of auto retail unfolds, Kerrigan Advisors expects growing dealership groups to continuously reassess their capital allocations. This reassessment may have positive or negative effects on future franchise values, depending on which way our industry evolves. One thing is for sure: when the unknown becomes known, industry changes will be priced into the buy/sell market. Until that time, most industry participants are studiously examining when, how, where and why auto retail will change.

Dealership profit variability widens blue sky pricing ranges

Dealership profit variability widens blue sky pricing ranges

After 2009, the vast majority of dealerships experienced sales and earnings growth. The rising tide lifted all boats. Today is a different story. Dealership profit variability has increased significantly with some dealers experiencing more earnings volatility over the last three years.

First and foremost, plateauing industry sales has resulted in a more competitive marketplace, creating winners and losers as industry participants go after a finite pool of consumers. While some dealers are successful at reducing expenses at a commensurate pace as sales decline, others struggle to adjust their operations. This results in a greater divergence in dealership profitability from franchise to franchise. Thus, even though blue sky multiples are not expected to adjust dramatically in the near term, dealership profits upon which they are applied will vary considerably from transaction to transaction, resulting in meaningful swings in franchise value even for the same franchise within the same market.

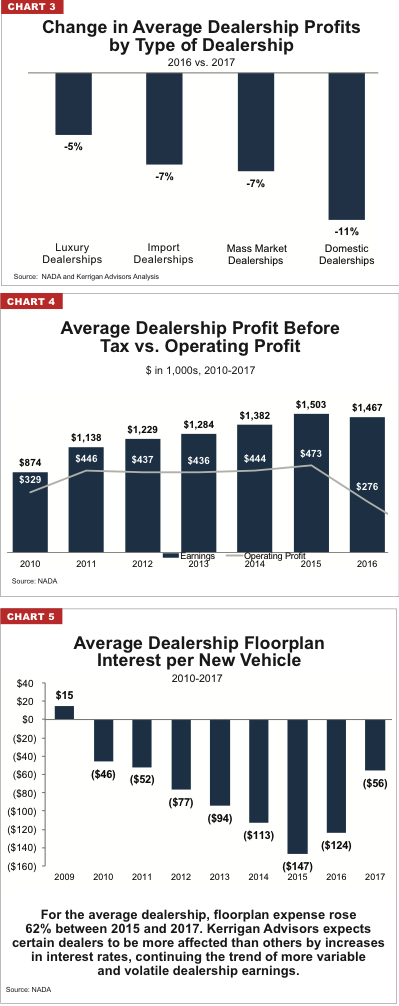

Dealership earnings were highly variable in 2017. In 2018, Kerrigan Advisors expects dealership earnings volatility will result in significant differences in transaction pricing from deal to deal. (See Chart 3)

We also expect earnings variability to have a meaningful impact on valuation in 2018, particularly as an increasing percentage of dealership earnings come from OEM incentives (see Chart 3).

When OEM incentives represent a larger portion of dealership profits, dealerships can have massive earnings swings from quarter to quarter, particularly when the OEM changes incentive goals and/or a dealership misses its targets. (See Chart 4)

Another issue which will vary dealership profitability in 2018 is rising interest rates. The Federal Open Market Committee reported that it “expects economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate. Most expect three or four increases in the fed funds rate in 2018. These rises will most significantly reduce the profitability of dealers who are accustomed to maintaining large amounts of inventory and higher days’ supply, further varying dealership profitability.

“I’d remind you that a 1% move in interest rates is $50 million pre-tax[expense] for us.” – John North, Chief Financial Officer, Lithia Motors. (2017 Fourth Quarter Earnings Call)

As we anticipate another very strong year of transaction activity, we see tax reform bolstering the capital resources of buyers, real shifts in investment strategies, and more variable performance across stores as important themes that will impact our industry in the coming months.