SAN FRANCISCO – The Presidio Group LLC recently released its Automotive Retail M&A Report for Year End 2011.

- Public Company Acquisitions in 2011 140% Higher than 2010, Top $500 Million

Some highlights of Presidio’s report include:

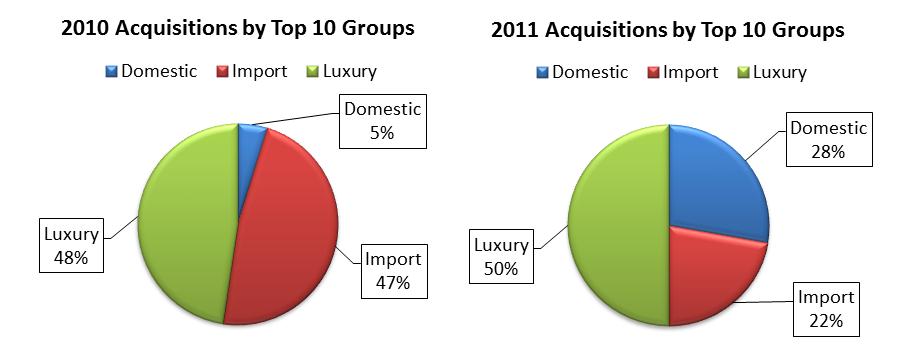

- M&A activity for auto dealerships was up sharply in 2011. Public retailers completed $512 million in acquisitions (according to corporate SEC filings), a 140 percent increase over commitments made in 2010. Though still well-below the 2006 all-time record of more than $1 billion, the past year’s activity represents an accelerating trend in the M&A market. Private buyers are also active though terms of their purchases of dealerships and dealership groups are not reported.

- The increase is attributable to a number of factors. The market was virtually frozen for three years, with just $28 million worth of acquisitions by public retailers in 2009 (according to SEC filings). Many dealers were awaiting more favorable conditions to exit their businesses. Strong unit sales, fewer marginal dealerships, lower operating costs, and record dealership profitability are making acquisitions more attractive for both public and private buyers. Stabilized real estate values and low interest rates are also contributing to the rebound in M&A activity.

- Rising consumer confidence, declining unemployment rates, more accessible financing, and the average age of existing vehicles (now 10.8 years, a record high according to the North American Auto Dealers Association (NADA)), are driving new vehicle sales higher. Leading analysts estimate 2012 new unit sales will be 9.2 percent above the 2011 figures, and that may be conservative given that the annualized rate from January and February is 18 percent greater than 2011’s sales.

- While the Big 5 dealerships (Toyota, Honda, Lexus, BMW, and Mercedes Benz) remain the most sought after acquisitions, five others (Audi, Chevrolet, Ford, Hyundai, and Nissan) are drawing increasing interest. In fact, Presidio raised its estimated blue sky multiples for twelve franchises in the report.

- Presidio believes the industry is still in the early stages of at least a five-year up-cycle, and anticipates continued high levels of activity for several years.

“All of the factors we saw driving M&A activity in the first half of 2011 remained in force through the balance of the year, and they appear to be gaining strength in 2012,” said Alan Haig, Managing Director and Head of Presidio’s automotive retail services group. “Dealerships and public and private dealer groups are booking sharply higher profits. Despite higher valuations, acquisitions remain attractive to buyers given the anticipated growth in dealership profits over the next several years. We anticipate 2012 will be another vibrant year in the M&A market.”

“All of the factors we saw driving M&A activity in the first half of 2011 remained in force through the balance of the year, and they appear to be gaining strength in 2012,” said Alan Haig, Managing Director and Head of Presidio’s automotive retail services group. “Dealerships and public and private dealer groups are booking sharply higher profits. Despite higher valuations, acquisitions remain attractive to buyers given the anticipated growth in dealership profits over the next several years. We anticipate 2012 will be another vibrant year in the M&A market.”

The full report is available here.

The Presidio Group’s automotive practice is the premier full service advisor for sellers of high value dealerships and dealership groups. The practice focuses on dealership transactions valued between $20 million and $300 million. Presidio’s professionals have been involved in more than 150 auto dealer related purchases, sales, and capital raises, totaling more than $4 billion. Its Automotive Retail M&A Market Report is a leading source of information on auto retailers and acquisition activity.

About The Presidio Group LLC. Presidio is a personal and corporate financial services firm, and one of the nation’s leading independent wealth advisors with client assets of nearly $4 billion. Through its interconnected investment banking, private equity, wealth advisory, and family enterprise strategies units, Presidio is uniquely capable of addressing the lifecycle challenges of wealth – from its creation, through its retention and growth, to its transfer to successive generations. The firm’s principals have extensive experience running businesses and creating wealth of their own; their understanding and management of risk is unsurpassed. Presidio and its subsidiaries currently serve clients throughout the United States. Presidio Merchant Partners LLC is a member of FINRA and SIPC. For more information, visit www.thepresidiogroupllc.com.