The financial markets, and in particular bank lending, play a particularly important role in today’s buy/sell market. Certainly, macro-economic trends such as interest-rates, economic growth, and consumer confidence have always directly impacted car dealership performance. Dealerships are on the front line of the American economy and are acutely sensitive to the Main Street economy.

What’s new is the amount of leverage that is now very typical in auto retail transactions. While every transaction is unique, we observe that typical market terms today include financing of 100% of the real estate, and 50% financing of blue sky, in addition to customary working capital and flooring lines. Given the long run of earnings growth, banks have become increasingly more aggressive in buy/sell lending. All told, the level of financing in today’s market is atypical, according to multiple veteran dealers with whom we’ve spoken on this topic.

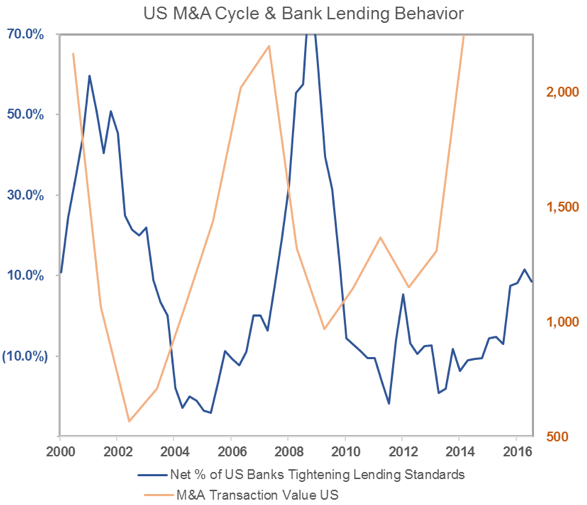

Just as the business press often discusses the “window” for IPOs (initial public offerings), commercial lending has historically operated in a very similar manner. Banks, each reacting to the same economic data, are generally all willing to lend more liberally in some periods, and will pull back considerably in other periods. The ‘pack mentality’ makes these movements all that much more impactful, as they are lending in unison, and then retreating in unison.

Source: Federal Reserve Bank of St. Louis – Economic Research and Institute for Mergers, Acquisitions and Alliances

These industry-wide swings contribute to extreme variation in the levels of mergers and acquisition activity in the US economy. As evidenced by the 15 year chart above, total acquisition activity (across all US industries) tends to be either rising quickly, or falling quickly. Significant change tends to be the ‘steady state’ of lending, and associated merger activity.

As the auto retail industry has matured, our industry has become accustomed to higher levels of acquisition finance. And, low interest rates have allowed acquirers to “pay up” and still achieve attractive returns on equity capital.

While we don’t attempt to predict how and when this cycle plays out, we can say with certainty that it will change.

And, when it does, earnings will, of course, suffer for a period of transition, as is customary in down cycles, but debt levels for highly acquisitive buyers will remain constant, significantly altering cash flow coverage and debt to equity ratios.

As discussed in my Dealer Magazine article in the July issue, the public auto retailers are largely sitting out the current buy/sell market given their depressed stock prices of the last twelve months. This has created a remarkable buying opportunity in recent quarters for many private consolidators. But, they, too, will likely be forced to sit on the sidelines for some time during a downturn. First, like all businesses, they will focus on getting their operations right-sized to assure profitability. But, even with the prospect of attractive deal opportunities, they will likely be forced to wait until they get their financial ratios back in line, and regain the confidence of lenders.

None of this is particularly new, but we do believe the magnitude of this cycle is greater than those of the past, and the borrowing capacity of the large private auto retailers has reached levels not seen before in auto retail.

Auto retail has always been, and will always be economically sensitive. In the next cycle, however, there will be much larger debt levels tied to acquisition finance that will put pressure on the rate of buy/sell activity.

For dealers who are evaluating their options in the current buy/sell market, there are a couple of key takeaways:

- Understand the remarkably dynamic nature of the mergers and acquisition market, and the tendency for velocity to change quickly, both in upward and downward fashions. If contemplating, or even in the middle of negotiating a transaction, market risk remains until the deal is completely finalized and funds are wired.

- The uniquely high levels of acquisition financing will likely reduce the pace of buy/sells in auto retail when banks begin to tighten, perhaps in a very dramatic fashion.

- Change always creates opportunity. We have witnessed this in the past year, as the private acquirers have been able to step in, and gain the upper hand in the last 12 months in acquisitions relative to the publicly traded companies. When bank lending tightens, some of the most active acquirers may be forced to the sideline for a period of time, opening the door to new buyers that have not been as active in recent years

For the moment, the pace of the buy/sell market remains very strong, but change is certain. In particular, monitor changes in banks’ lending policies as an indicator of things to come.