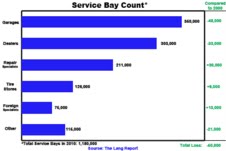

GRAPH TO BE INCLUDED

There are 50,000 fewer service bays in the United States than there were ten years ago. According to The Lang Report, there were 1,180,000 services bays in 2010 compared to 1,230,000 in 2000 (see graph below). Dealerships lost a whopping 33,000 service bays in the last decade…many of these as a result of recent closures and consolidations.

In the big picture, dealerships have 25.7% of all service bays in the nation. In other words, the independent aftermarket has dealership service bays outnumbered three to one.

I’ve been following these trends for as long as I can remember, and frankly, this is nothing new. Dealers have been losing market share for a long time. According to James Lang, publisher of The Lang Report, this trend will continue into the foreseeable future.

Independent service centers have also been impacted, especially service stations and smaller garages. Despite this overall decline in service bay count, there has been significant growth in specialized repair facilities, tire stores and foreign repair shops.

While service bays have declined, the number of cars on the road has dramatically increased! In 2000, there were 200 million cars on the road compared to almost 250 million in 2010. Therefore, we have 50 million more cars and 50,000 fewer service bays. Let’s apply some basic economics to this situation: the demand is way up (50 million more cars), and the supply is way down (50,000 fewer service bays). Therefore, the most valuable piece of real estate your dealership owns is a 12 ft. by 20 ft. piece of concrete called a service bay. This 240 sq. ft. chunk of ground produces more gross profit than the showroom, the parts department, or the front lot. If your effective labor rate is $80 and your gross profit is 70% ($56), then your service bays produce a gross profit of $.23 per square foot, per hour ($56 ÷ 240 sq. ft.).

Note: Since labor sales drive parts sales, this number will be even higher due to the parts sales, probably at least 50% higher.

With the possible exception of F&I, no other department produces that kind of income per square foot for your dealership. Additionally, it requires very little upkeep, minimal climate control and the floor covering never needs to be changed.

It is absolutely imperative that a service bay has four tires on it or slightly above it at all times. Of even more importance is service bay “turn over” or efficiency. If you tie up a service bay for two hours on a job, that only pays .7 flat rate hours, well, that’s not the best usage of this valuable plot of earth.

The desired outcome would be having a vehicle in the bay for 30 minutes and flagging an hour or more. At the very least, you want to be at 100% efficiency.

So how do you maximize the service bay? How do you make the most money in the shortest amount of time?

It’s not gonna happen doing warranty work. It’s not gonna happen fixing broken stuff (repair). Even oil changes, while vital to long term retention, are not highly efficient or profitable.

Maximum service bay utilization can only be realized through the performance of maintenance service work.

Maintenance services are usually over 200% efficient; the techs love the gravy work and the service bays stay full. Of equal importance is the benefit the vehicle owner receives by having a much lower cost of ownership, because maintenance is always cheaper than repair.

However, there is a catch, maintenance service needs have to be recommended by the technician and sold by the advisors. Most vehicle owners don’t know how to maintain their cars in such a way to prevent breakdowns.

It’s the job of your techs and advisors to educate the vehicle owners, offer the needed maintenance services, and ask them to have the service work done while you have their car in the shop.

At the risk of sounding simplistic, if you want more revenue per square foot of service bay, then hold your advisors accountable to sell maintenance services. Everyone comes out the winner: techs, advisors, management and most of all, the customer.

More cars and fewer bays…what an incredible opportunity!

My personal thanks to Mr. Lang for letting me reference his research. For more information on The Lang Report, you can visit his web site at www.langmarketing.com.