Sales & Variable OPS

Numa Launches Voice AI-Powered Smart Inbox to Transform Dealership Communication

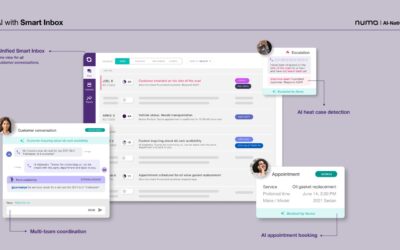

Numa, an AI platform for dealership customer operations, has unveiled its new Voice AI-powered Smart Inbox, a tool designed to revolutionize how dealerships handle customer communications. By integrating voice AI with a shared, context-rich inbox, Numa aims to solve a...

Ivette Dominguez Drawe Inducted into the Colorado Automotive Hall of Fame

Alpine Automotive Group CEO Honored for Industry Leadership, Innovation, and Community Impact

Land Rover Boerne Sold to Sewell Automotive Companies

The Presidio Group exclusively advised Sewell Automotive Companies on the acquisition of Land Rover Boerne from Shottenkirk Automotive Group

Convergence Expands Nationwide to Help Dealers Boost Sales and Service with Personalized Messaging

We live in an increasingly digital age. Auto dealerships, long built on face-to-face communication in the show room, have to navigate customers that now expect timely, but personal communication on the go. Attempting to engage with customers is easier than it's ever...

Toma Introduces Inbox and More Safeguards After Automating 1M+ Calls

AI agents with dealer-specific safeguards now pair with a unified Inbox to resolve customer requests faster while keeping staff in control.

Fact Based, Not Fear Based: The Future of Fixed Ops Communication

Technology can streamline communication, but only good processes build trust. I was recently sitting in a service lounge waiting to meet with a manager when I noticed a young woman approach the counter. She’d received a text saying something on her vehicle needed...

Chevrolet Dealerships Ranked Most Consistent in AI Study

In a first-of-its-kind study leveraging artificial intelligence and computer vision, Chevrolet has been ranked number one for dealership facility consistency across the United States. The 2025 Dealership Facility Consistency Study, conducted by Pied Piper, utilized a...

EPIC Adds Veteran Automotive and Tech Leaders to Board as Demand for Digital Loan Payoff and Real-Time Title Transparency Grows

Board to guide EPIC’s expansion of digital infrastructure for loan payoffs and real-time title transparency, driving scalable efficiency across the automotive ecosystem

Data Axle and Tealium Partner to Bring Real-Time Data Intelligence to Automotive Marketing

New survey reveals 68% of dealership outreach fails to connect, signaling an urgent need for smarter data practices

Join us for Digital Dealer Las Vegas 2021