By Ryan Kerrigan, Managing Director, Kerrigan Advisors. 2019 is another very active year in the auto retail buy/sell market, with transaction activity once again on track to exceed 200 transactions. Based on our transaction and consulting work across the U.S. and Canada, we have observed three trends shaping the current buy/sell market and setting the stage over the coming months and quarters.

- Improvements in dealership earnings sustain Blue Sky Values

- Publics’ stock price appreciation portends future acquisitions

- Lower interest rates support an active buy/sell market

Improvements in Dealership Earnings Sustain Blue Sky Values

In the last four years, the decline in blue sky values was primarily a result of lower earnings, rather than declining multiples. However, after four years of slight earnings declines, average dealership profits rose in the first half of 2019, despite a reduction in new vehicle sales. This increase drove average blue sky up slightly for the first time since 2015, reversing the industry’s four-year downward trend.

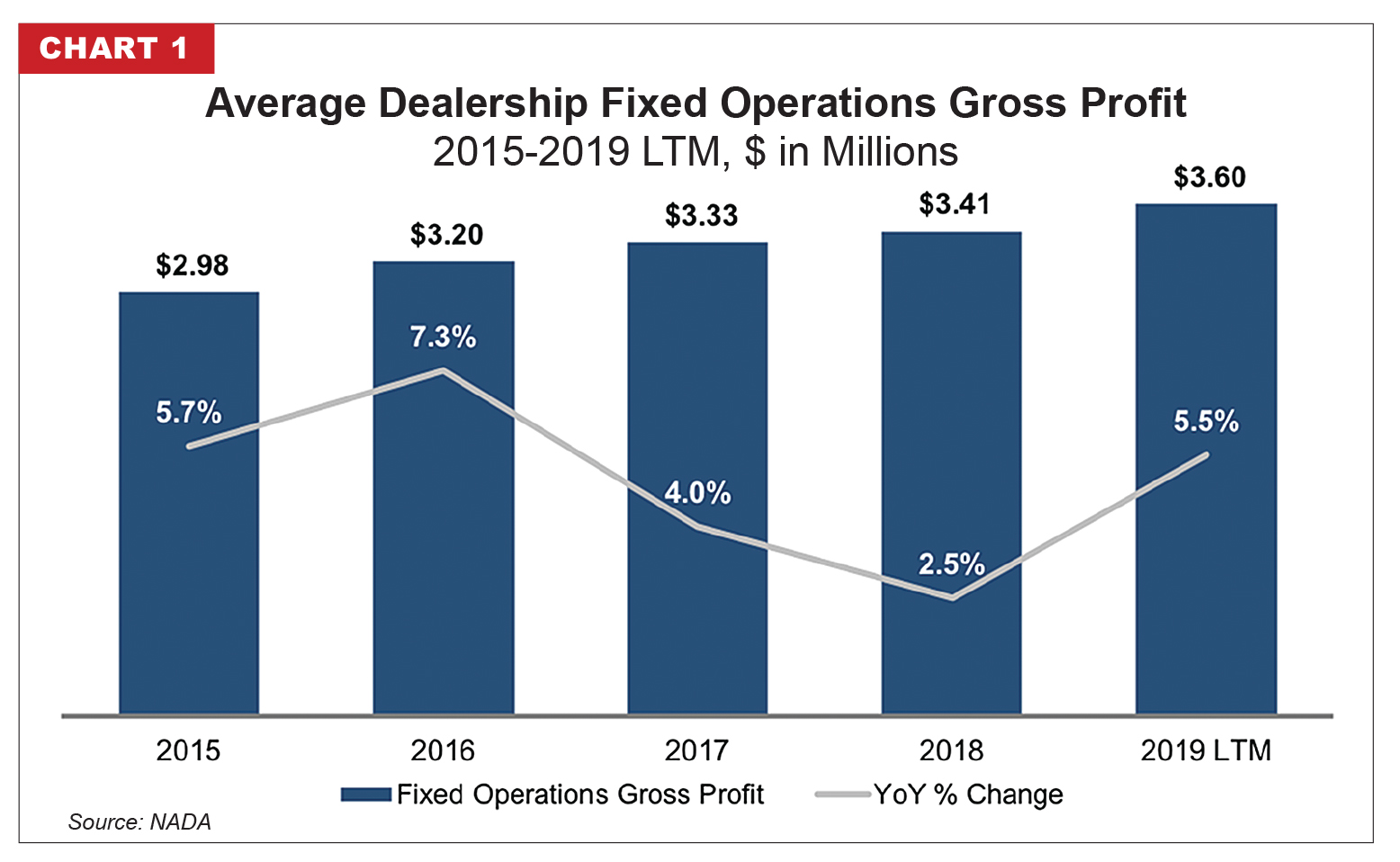

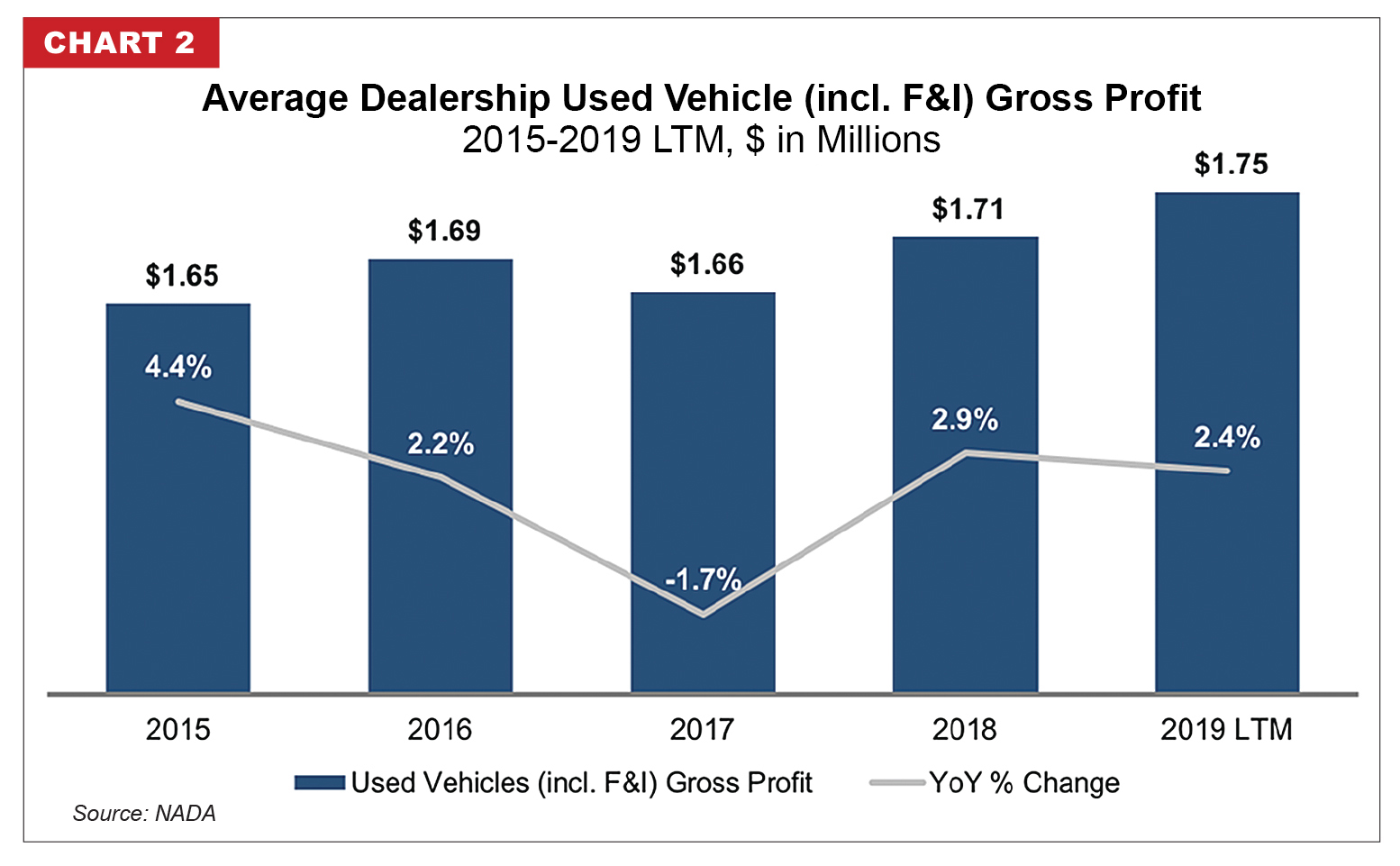

The rise in profits was driven by growth in higher-margin business segments, namely fixed operations and used vehicles, which grew 5.5 percent and 2.4 percent, respectively. Today, used vehicles and fixed operations, which earn gross margins 109 percent and 747 percent higher than new vehicles, are the driving force of industry profits and collectively represent 75.9 percent of the average dealership’s gross profit.

These segments are considered counter cyclical by nature, meaning they tend to grow when the economy contracts. When consumers reduce their new vehicle purchases, they often buy less expensive used vehicles or keep their older vehicles which require more service. Many dealers, including some of the public companies, will achieve record profits in 2019 because of the growth in these two higher-margin segments, despite declines in new vehicle sales. In this regard, auto retail has an ideally balanced business model – when the economy is strong, new vehicle sales are high and profits are strong, and when the economy is weaker, used vehicle and fixed operations sales grow, maintaining dealership profitability.

Backed by these counter cyclical revenue streams, dealership earnings should remain strong throughout 2019 and sustain today’s blue sky values into 2020, even in the face of a possible recession. The fixed operations business is well-positioned to continue its current growth rate as electric vehicles take an increasing share of sales. Electric vehicle customers have higher service retention rates, as well as elevated spending levels per service visit, alleviating the concern that electric vehicles will not require dealership service. Likewise, used vehicle sales are expected to grow as inventories of late models rise due to a growing volume of off-lease vehicles coming to market.

Growth in dealership profits is also bringing more buyers and investors to market. Increased buyer demand is supporting the continuation of today’s blue sky multiples, despite recession concerns. In fact, some investors are interested in auto retail specifically as an economic hedge against a recession. With this in mind, we expect average blue sky values to remain strong over the next two quarters, as industry profits stabilize and buyer demand remains high.

Publics’ Stock Price Appreciation Portends Future Acquisitions

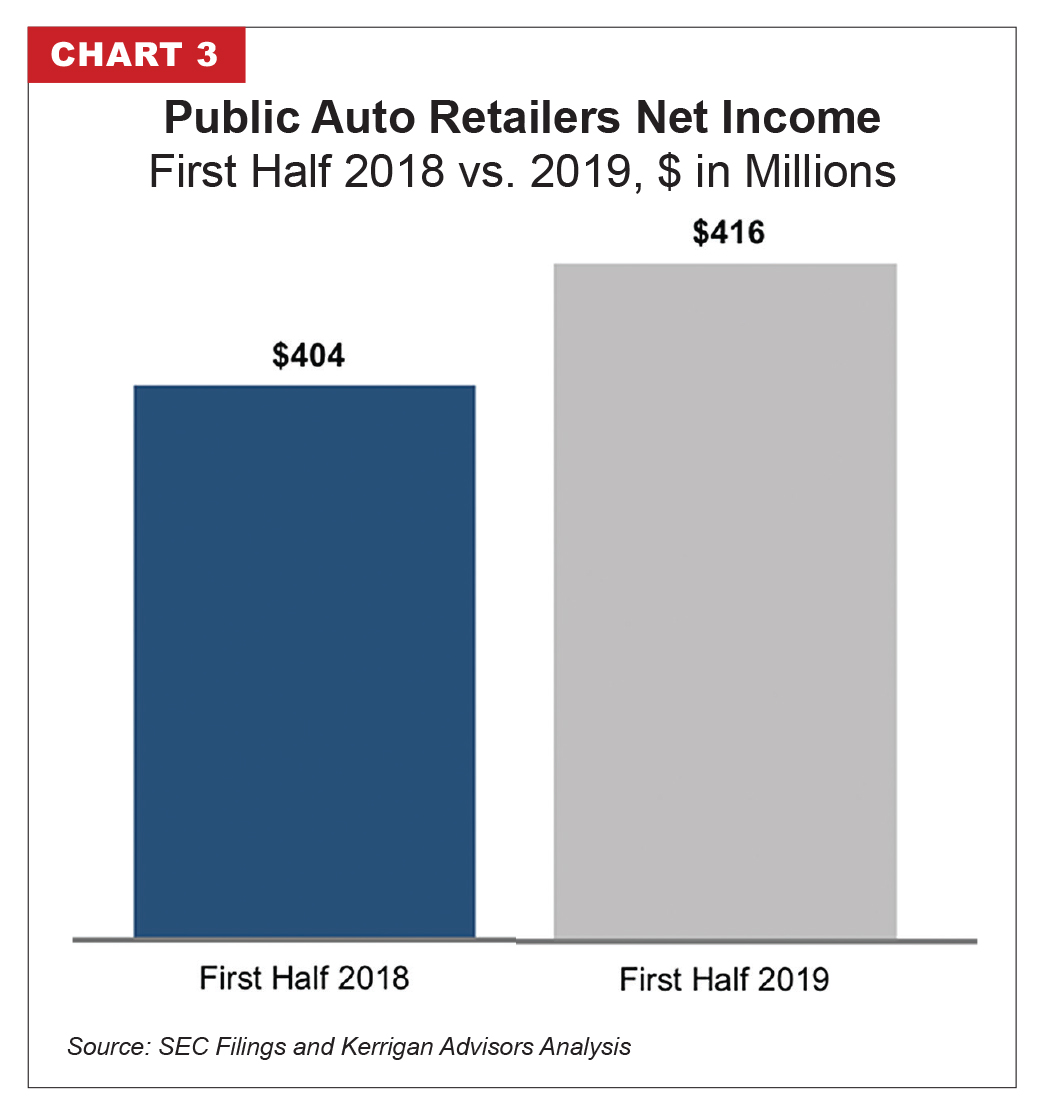

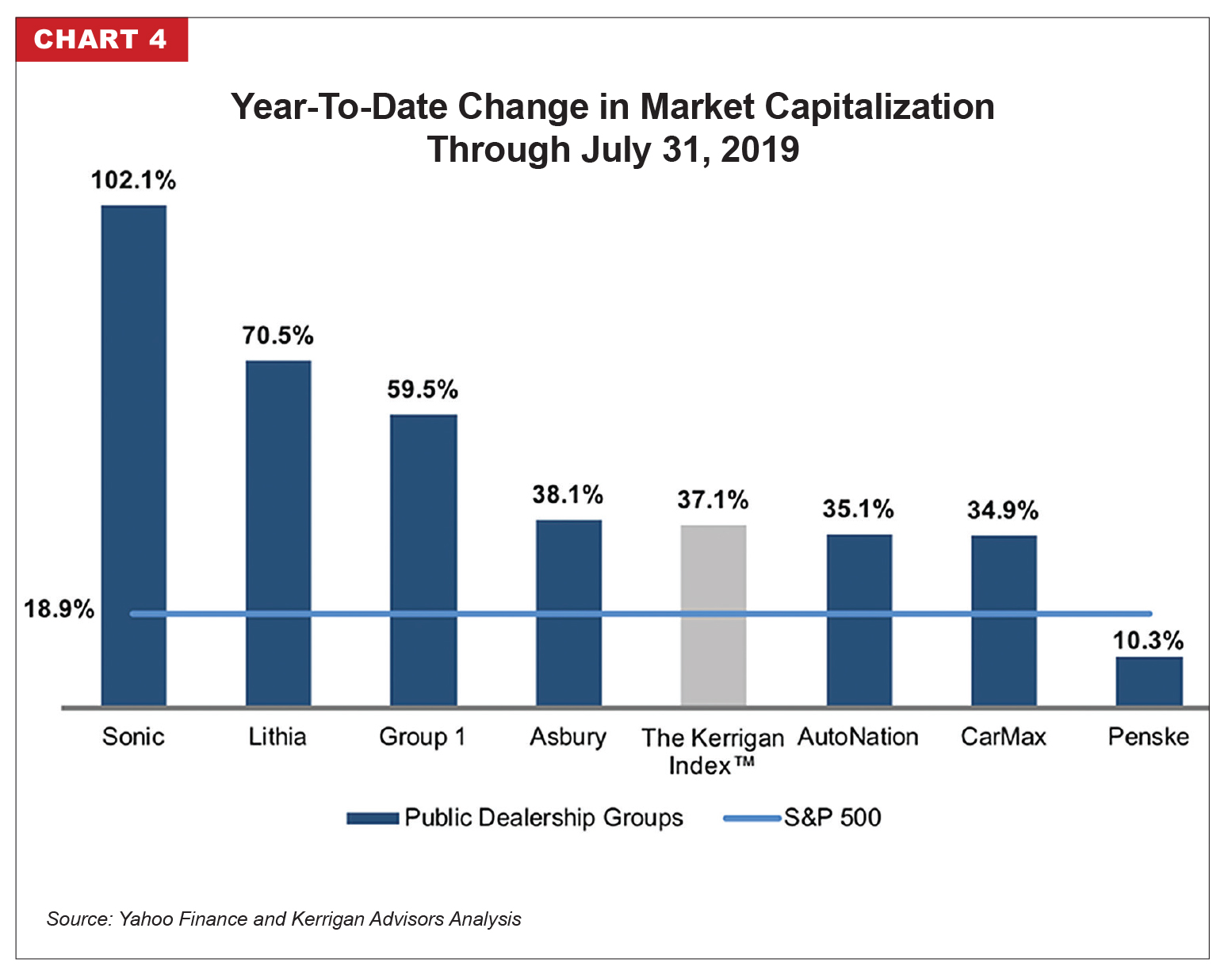

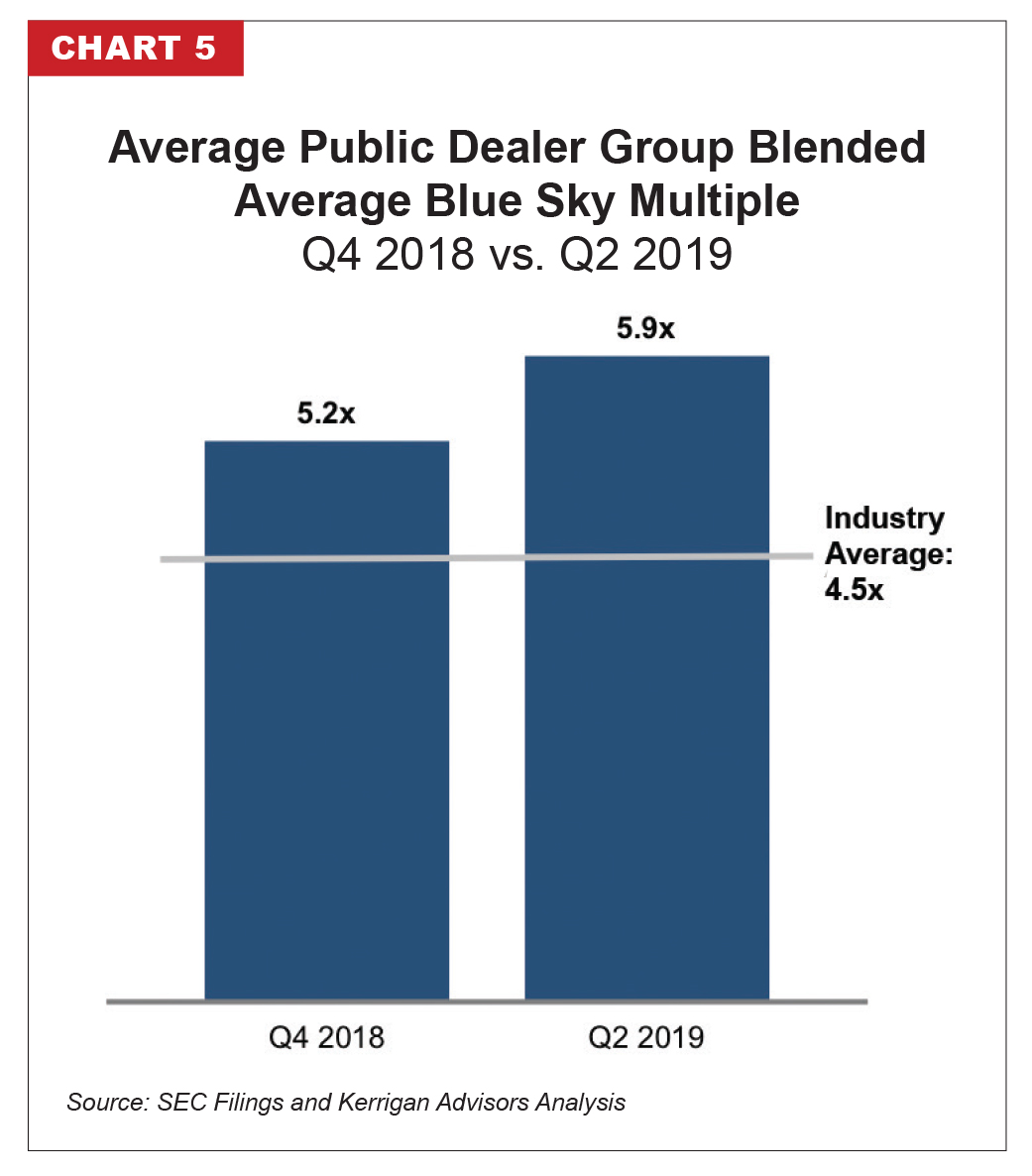

After a significant decline in acquisitions in the first half of 2019, public auto retailers are expected to increase their capital allocation to U.S. dealership acquisitions in the second half of 2019. This is not surprising given their strong financial performance in the first half (five of the six reported record earnings in the first half – see Chart 3) and rising stock prices (see Chart 4). Year-to-date through July 31st, The Kerrigan Index™ is 589.25 and up an impressive 37.1 percent on average (see Chart 5).

Public companies have a fiduciary responsibility to seek the most accretive investments for their companies’ capital. For some time, the pricing of their stock rendered many dealership acquisitions dilutive to earnings and made stock buybacks more attractive; however, with the recent rise in their market capitalizations, and the concomitant increase in their blue sky multiples, many dealership acquisitions are once again accretive to the publics’ earnings (see Chart 5).

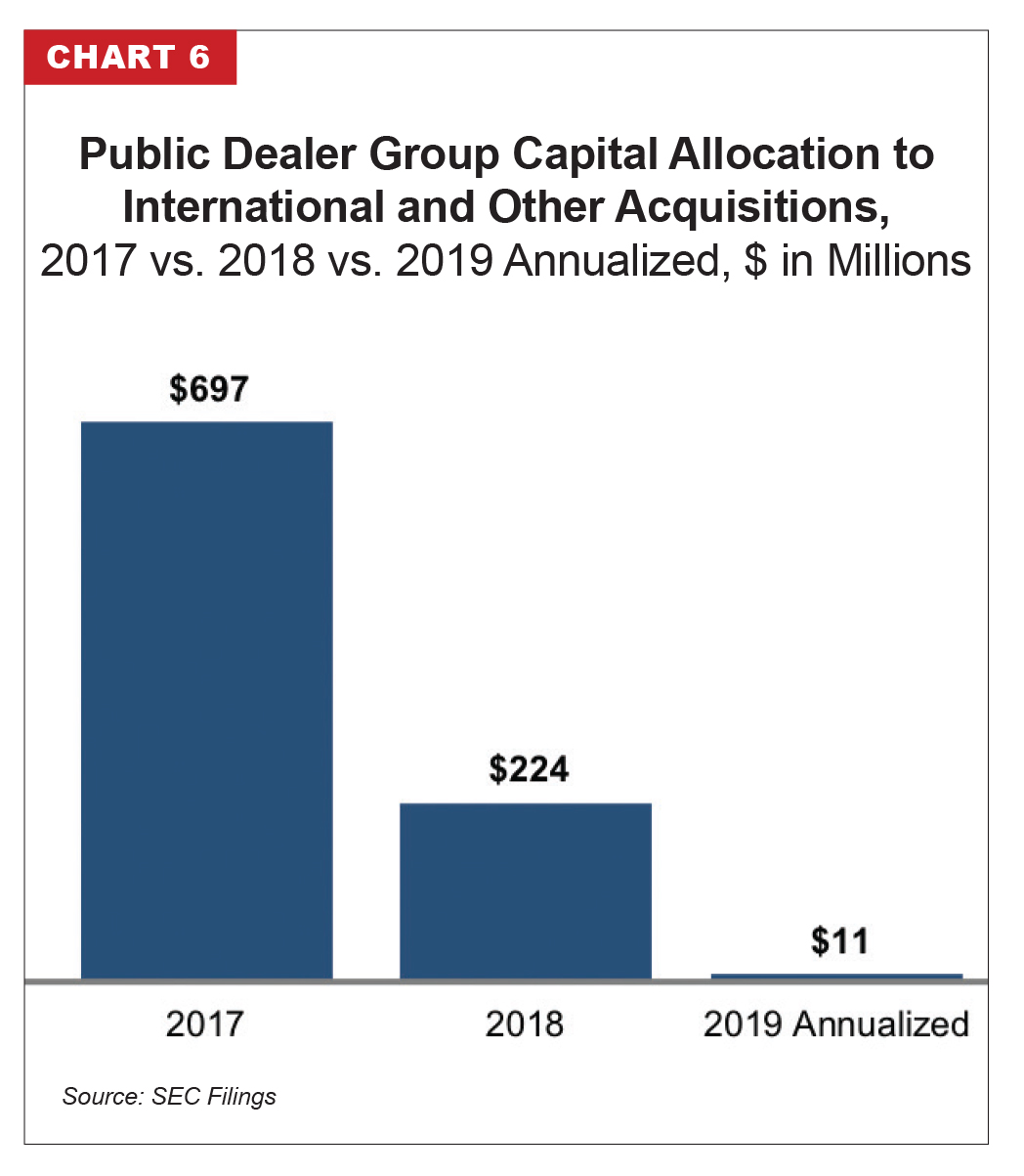

As U.S. dealership acquisitions become more financially attractive to public companies, we expect less capital will be allocated to other investments and foreign acquisitions. As shown in Chart 6, capital allocation to these investments has been on the decline since 2017.

Lower Interest Rates Support an Active Buy/Sell Market

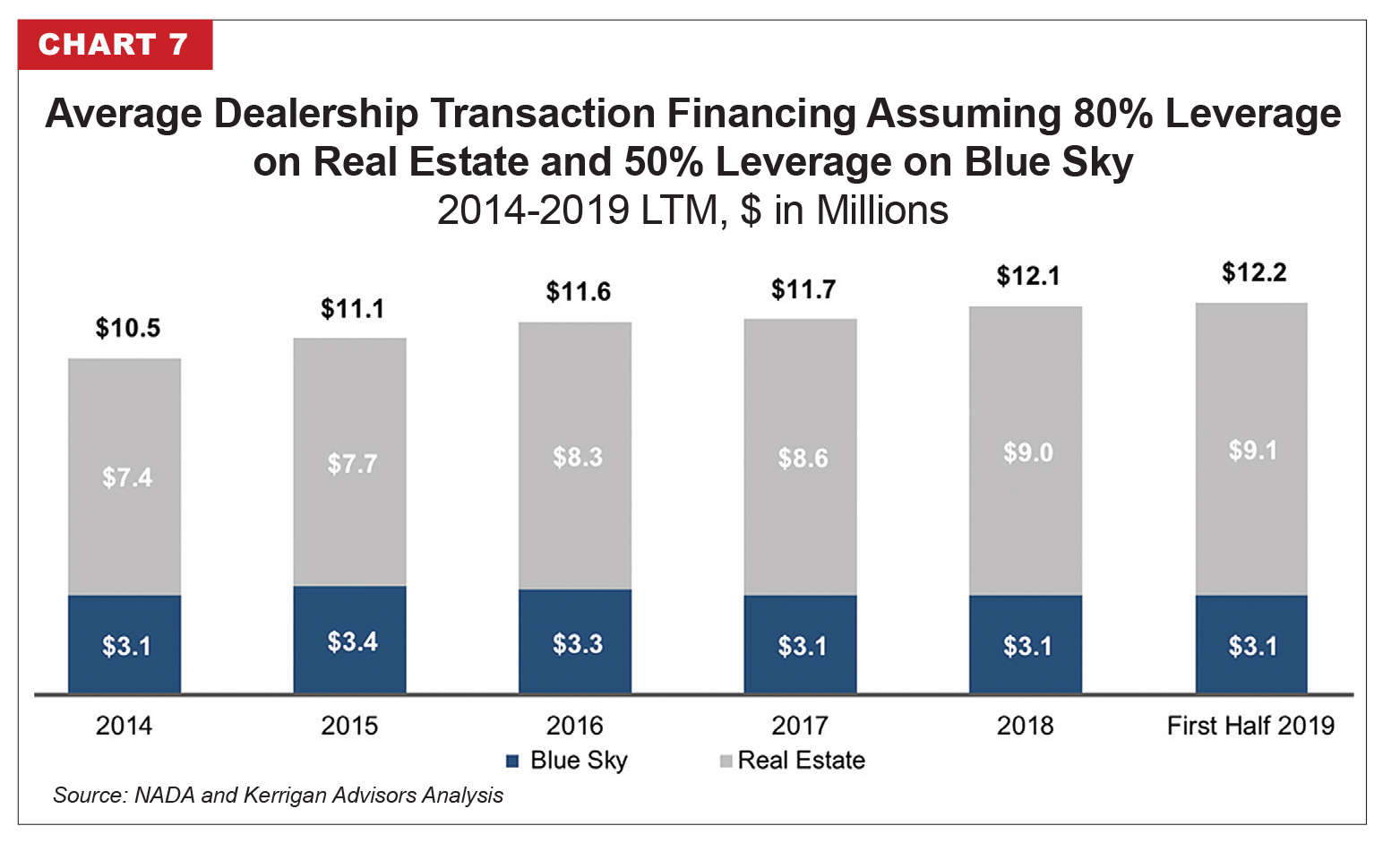

Financing is a key component of the buy/sell market and blue sky values. Buyers logically tap into acquisition financing to reduce their equity investment and improve their return on equity (“ROE”). Financing is often the most crucial element of getting a transaction done in today’s marketplace. In many cases, buyers borrow more than 80 percent of the real estate purchase price and 50 percent of the blue sky. Based on today’s average real estate and blue sky values, acquisition financing averages $12.2 million per transaction (see Chart 7).

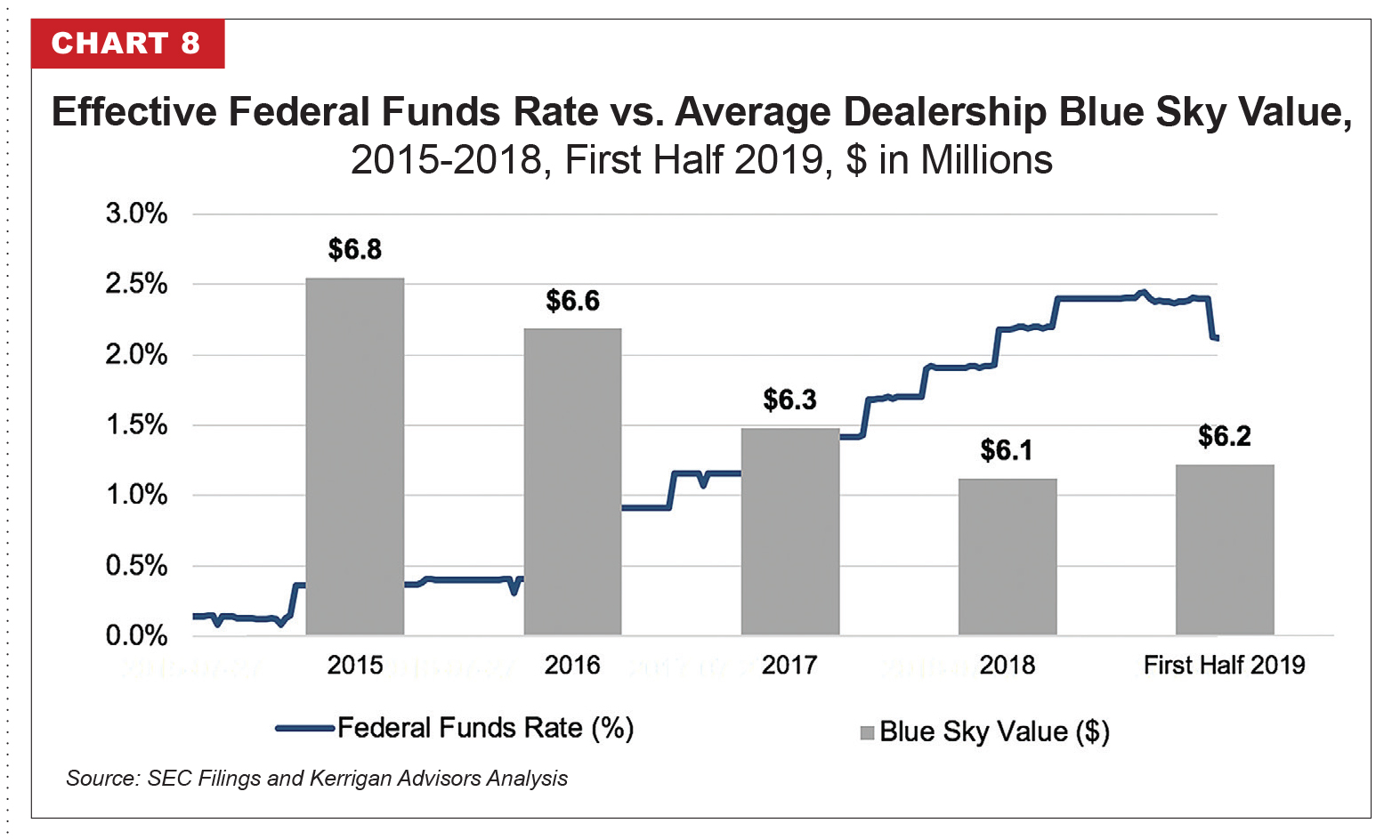

Given the high levels of financing in today’s buy/sell market, interest rates are incredibly important to the health of the buy/sell market. Kerrigan Advisors’ analysis shows that blue sky pricing, for instance, is inversely correlated with interest rates. As interest rates rise, blue sky values tend to fall. With this in mind, this year’s decline in interest rates is expected to support an active buy/sell market and potentially higher blue sky values (see Chart 8).

“If I go back six months ago, nine months ago, and I looked at the forward curve you could have expected a higher interest rate environment in the second half of 2019 going into 2020. And now from today’s perspective, there’s a very good chance that we’re going to be seeing rate cuts not rate increases. So that’s a huge change in mindset.” –Mike Jackson, Chairman, AutoNation, Second Quarter 2019 Earnings Call

Furthermore, lower interest rates render the financing of vehicles more affordable, potentially increasing new vehicle sales or at a minimum reducing the decline. Like blue sky, new vehicle sales are inversely correlated with interest rates. Thus, rate reductions will provide clear benefits to the auto retail industry and support sustained industry profits, high levels of buy/sell activity and strong valuations.

“From a consumer point of view, the lending environment at the moment is very favorable. We haven’t had any issues obtaining financing for our consumers, but I think as interest rates decline that can only be positive for the consumer.” –David Hult, President & Chief Executive Officer, Asbury Automotive Group, Second Quarter 2019 Earnings Call

In summary, the buy/sell market continues to power through a period of flat SAAR and tepid top-line growth. However, dealers have pivoted to the elements of the business model that remain healthy and have higher margins. As such, profits remain robust, and deal activity remains strong. The public markets are also reflecting these positive developments, and the public auto retailers’ stocks are up sharply year-to-date. And, the lubricant of all transactions, interest rates, remain low and have been dipping yet lower. These factors underline the conditions for continued health in buy/sell activity in 2019 and into 2020.

About the Author

RYAN KERRIGAN is managing director of Kerrigan Advisors, the leading buy/sell advisor to auto dealers in the US. Ryan oversees capital raising and private equity/family office investor relations, in addition to transaction and consulting work. He started his career at McKinsey & Company as a management consultant, advising Fortune 500 companies on growth strategies, organizational issues, and business valuation. Ryan also has extensive experience in auto retail, having been a general manager of his family’s dealership. EMAIL: [email protected]