I am regularly asked two questions from dealers: Is the buy-sell market still strong, and have I missed the window to sell?

While there is no perfect crystal ball, there is one indicator that merits strong attention – the stock market, and specifically the seven publicly traded auto retail stocks (the “publics”).

The stock market represents the collective analysis on a given company about its future. Just like any private company, a public company’s valuation is based upon its earnings, and most importantly, the market consensus on the future earnings of that business.

Unlike private companies, public companies get analyzed and re-valued every day that the stock market is open. While the operations of a public company do not change much from day to day, the macro economic issues that affect a public company’s performance, and its future earnings potential, do change from day to day. For example, the stock prices of the “publics” get re-assed daily based on the latest news concerning SAAR, interest rates, consumer borrowing trends, and countless other macro-economic factors.

Given such real-time valuation analysis, it is instructive to follow the publicly traded auto retailers to try to gain some glimpse into the future of our industry.

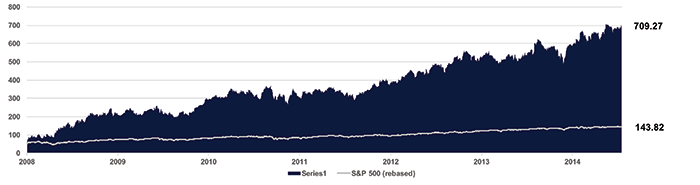

For example, after the lows of 2008 to the high in June 2015, auto retail stocks have had a magnificent rise. The KAR Index™, which is composed of the seven publicly traded auto retail companies (AutoNation, Penske, Lithia, Group 1, Asbury, Sonic and Carmax), rose an incredible 968% from its low through June 2015, vs. 178% rise for the S&P during this time frame. And, price-to-earnings ratios reached as high as 15.6x. (Price to earnings ratios reflect the value of a public company relative to its earnings, much like blue sky multiples reflect a private company’s franchise value relative to its earnings.) This valuation metric represented the collective view that, in addition to strong earnings, earnings growth was robust and expected to continue.

The KAR Index™ compared with the S&P (11/20/2008 – 6/5/2015)

Concurrent with this rise in public valuations, the dealership buy-sell market flourished. With high stock prices, the public companies increased their spend on US acquisitions to a record $1.50 billion in 2014 and another $832 million in 2015. They were able to pay higher prices because most transactions were accretive to earnings (a transaction is accretive to a public company’s earnings if the multiple the public pays for the private company is lower than the public’s current P/E multiple). And, private dealership companies followed suit, benefiting from aggressive lending from banks that were also emboldened by the strong performance of auto retail in the equity markets.

“There is no perfect crystal ball, but the stock market works very hard to foresee the future, and merits some attention from those considering selling their businesses.”

This all led to the recent golden era for sellers in which earnings were strong and blue sky multiples were equally strong.

However, at least according to the public markets, that era may be coming to an end.

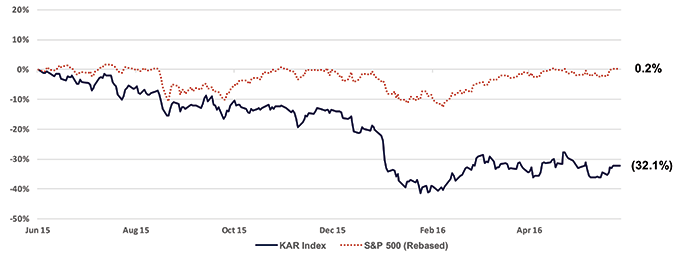

The KAR Index™ has fallen 32.1% since mid-2015, contrasted with the general market performance which is flat at +0.2%.

Change in The KAR Index™ Compared to the Change in the S&P (6/30/15 to 5/31/2016)

With car sales booming, why are these companies’ valuations being hurt more than other industries? The consensus is that auto sales are near their peak, taking away the growth story. And, history tells us that margins decline when the industry is not growing. Thus, the growth and earnings of the public companies are expected to decline in the coming years. The stock market is a reflection of this expectation.

Is the era of the buy/sells over?

Not (quite) yet, in our estimation. Deals, particularly large ones, can take a long time to get done, and we believe that many significant transactions not yet announced will close in 2016. Additionally, the most active buyers in this most recent run-up have not been the publics – but private dealership companies, which represented 64% of acquisitions in 2015. The calculus of private buyers is slightly different than the publics. As long as they continue to get financing, the private buyers can make decisions independent of the stock market, and many private buyers rationalize high multiples with the absence of other avenues to earn return on their capital. Private buyers are also long term investors who think in terms of a 5+ year investment horizon, versus the publics who report quarterly to Wall Street.

With that said, we anticipate that pricing and buying by the public companies will trend down in 2016, and private buyers could also follow suit thereafter. In an industry as large as auto retail, there will always be contrarians and new entrants seeking to deploy capital, so buy/sells will continue to happen, especially given the ageing of the dealer body. But, the overall prices and pace will likely cool in 2017.

There is no perfect crystal ball, but the stock market works very hard to foresee the future, and merits some attention from those considering selling their businesses.