The buy/sell market has picked up considerably from the low it hit in 2009. That said, we at Presidio are surprised at the current level of transaction activity. In stark contrast to the big uptick we saw in 2011, buy/sell activity declined considerably in the first half of 2012. Just look at the publics’ U.S. acquisition spending in the first half of the year, it is down 55% from last year (see Chart 1).

Chart 1

Public Company Acquisition Spending

Public Company Acquisition Spending

Sources: Public Company SEC Filings

The decline in deal activity appears to be driven primarily by sellers, not buyers. The leading buyers are anxious to put money to work. They have a tremendous amount of cash flow as well as access to attractively priced debt. Leading buyers are proactively making calls to potential sellers. How are those calls being answered? In some cases by unrealistically high prices.

In Group 1 Automotive’s latest earnings call, CEO Earl Hesterberg stated, “There is a big gap between the prices being asked by sellers and what would enable us to make a fair return on our investment (ROI).” When determining purchase price, today’s buyers are driven primarily by ROI, rather than a seller’s “number.”

In reality, a seller’s “number” has little meaning if a buyer is unwilling to pay it. I often start my industry presentations reminding my audience that a dealership’s value is only determined when a commercial exchange takes place – when a buyer and seller see eye to eye on price and agree to make a deal. In today’s market, this is not happening often enough. The market has not found pricing equilibrium. Asking prices appear to be too high for the market to clear at a normal pace (particularly given the number of soon-to-be retiring dealers).

Because asking prices are perceived as too high, buyers are deploying their capital in other ways. Buyers have alternative options for their capital. They can allocate their cash to dividends, debt repayment, facility investment, add-points, or just keep it in the bank and avoid risk. Public buyers also have the option of buying back their own stock, something they have been doing a lot of this year (see Chart II). AutoNation spent nearly $1 billion on stock buy backs and zero dollars on acquisitions in the last reported 12 months (June 2011 to June 2012).

Capital Allocation of US Public Auto Retailers

Sources: Public Company SEC Filings

Buyers can also go abroad with their capital, as the publics have (see Chart 2). Roger Penske recently commented on his second quarter earnings call, “Pricing is significantly lower in international markets.” Lower prices can often result in a higher ROI and will lead to a larger number of transactions in international markets, which is what we are seeing today.

Many buyers expect a 12%+ ROI when buying a dealership. This may seem high given today’s low yielding investment environment; however, if you believe markets are rational (which I do), then perhaps buyers’ high return expectations are driven by the current economic uncertainty and the belief that future dealership earnings will be affected. As risk increases and the potential for profit growth decreases, buyers lower the multiples they are willing to pay for blue sky in order to achieve their expected ROI.

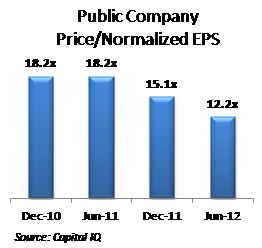

In Presidio’s semi-annual M&A report published in August 2012 (available to download at www.presidioautomotive.com), not surprisingly most of the blue sky multiples we report came down from 2011’s peak levels. These reductions also reflect buyers’ views that dealerships have less upside as the industry moves closer to a 16M unit SAAR. The public markets mirror these lower valuation multiples. Even with many of the publics reporting peak earnings, Wall Street is pricing the group at a lower P/E multiple (see Chart 3). If P/Es continue to decline, it will make private dealership acquisitions for the publics less accretive to earnings and will put further pressure on the multiples the publics are willing to pay.

Public Company Price/Normalized EPS

Source: Capital IQ

This all said, we believe that the clearing price for dealerships today is still very attractive. Most dealerships are experiencing record or near record profits. Even at slightly lower multiples, blue sky values are very high. A seller should be pleased with the offers he receives if he goes to market and will likely receive multiple offers at a fair price.

How to respond to a buyer in today’s market

If you get an unexpected call from a public or private buyer today, be prepared. As evidenced by the discussion above, we are not in an easy buy/sell market in which buyers are clamoring for deals at any price. Working with a single buyer in a non-competitive process will rarely produce the highest market price, especially if that buyer is highly experienced. Selling your business on your own is sort of like bringing a knife to a gun fight – not recommended.

For most dealers, their business is the single most valuable asset they own, and yet they sometimes don’t treat the sale of that asset in that manner. Would you sell a commercial property without a real estate broker? Would you sell a house without a realtor? Then, why would you sell your business without an advisor?

In today’s market where fewer transactions are closing and multiples are down, obtaining a premium blue sky value is challenging. By hiring an advisor to run a professional, confidential and competitive process, you have a much better chance of selling your business at a full market price. An experienced advisor could analyze your financials, accurately adjust your pre-tax profit and build an investment case that maximizes blue sky. Furthermore, confidentiality is more easy to maintain and buyers more easy to vet when an intermediary acts on your behalf. An advisor not only finds a buyer and negotiates a price, but most importantly manages the process (sometimes the hardest part).

Selling a dealership, like running one, is a full-time job. While you focus on running your business, your advisor can focus on getting your deal done. You only sell once – do it right.