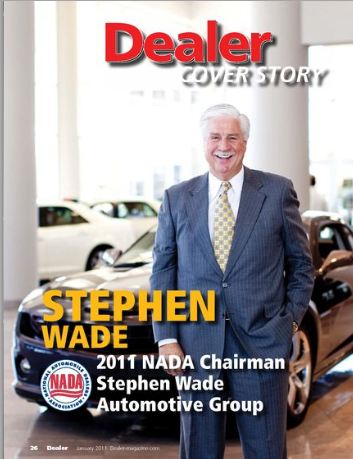

He started out wanting to be an attorney with no intention of being in the car business. Now, Stephen Wade is this year’s incoming chairman of NADA after almost 40 years of being a dealer. He shares with Dealer magazine the numerous challenges the association will focus on this year.

He started out wanting to be an attorney with no intention of being in the car business. Now, Stephen Wade is this year’s incoming chairman of NADA after almost 40 years of being a dealer. He shares with Dealer magazine the numerous challenges the association will focus on this year.

Wade started in the business with a Mazda franchise in the early ‘70s. He now sells Chevrolet, Honda, Cadillac, Dodge, Chrysler, Jeep, Nissan, Mazda, Toyota, a powersports dealership in St. George, UT, a small metro area of about 80,000 people. He also just acquired a dealership in California with Cadillac, GMC, Buick, Mercedes, BMW, Volvo and Subaru franchises.

Stephen, dealers have had some tough times the last couple of years. Are we coming out of it?

People ask me all the time where I think the industry is headed. I read an analogy the other day that I like. The robins are out. It’s springtime. We still have a chance for some inclement weather, but you know we’re headed in the right direction.

It changes the way you think and feel and that’s what is happening to dealers today.

We’re seeing good signs. And you know people love to buy cars, which we saw during and after Thanksgiving. But I do think we need to get to the point where people feel like their homes are worth what they owe on them. When that happens and the employment outlook improves, we’ll see consumer confidence improve, and then our industry will really take off.

I’m a car dealer, so you know I’m an optimist.

Another good sign is that most dealers and the manufacturers have restructured their businesses to where they can make money in a year in which only 9.5 million or 10 million cars are sold.

That’s true. I was at the White House three times over the last couple of years with the leadership of NADA, and the administration made it very clear that they wanted GM and Chrysler to be able to operate on 10 million units a year. And they wanted the dealers to be able to do the same.

So most dealers are at a point now where they can survive?

If you have a sign out front today, meaning you’re still in business – and I know there are still a lot of dealers struggling – they have probably weathered the worst of the storm and things are looking better.

Dealers that have been smart are the ones who were able to make the cuts where necessary.

We had to do that. We had to strip everything down. We learned we could operate in ways we never thought possible before. And I think that is true of most dealers. We had managers saying “We can’t do that. We can’t operate with that many people.” But we did it. We had to cut inventory and employees. We got rid of all the frills. We learned to work in this environment.

But it’s not fun. At my dealership it seems like there are many months when we’re not sure if we’re going to make a profit till the end of the month. We’re just pulling teeth, watching every penny, crossing every t and dotting every i.

Dealer profitability on new car sales is not there any more to allow any mistakes.

What would you say is key right now for your business?

Inventory management is big for us. And used cars have been key. When I started in the business in the 1970s, I had a Mazda store but then got a Pontiac franchise in 1975. They asked me to put a body shop in and I remember saying, “Oh no. Please don’t make me do that.”

But, I’ll tell you, today my body shop is one of my most important businesses. And if they had told me in 1975 that I didn’t have to have a service department if I didn’t want it, I would have said, “Great!”

Well, today, it’s all about absorption and offering our customers a full selection of services. The factories have cut so much of our profitability with so many costs being transferred to us. It’s almost impossible to make money on new car sales. Most new car departments don’t make money, so dealers have to do it with fixed operations and with used vehicles.

It seems as if the business is much more challenging today.

You’re right. We are challenged on so many fronts away from the dealership. One recent example is the Dodd-Frank Wall Street reform legislation. NADA member dealers across the country successfully urged their members of Congress at the grassroots level to preserve dealer-assisted financing as a viable option for car buyers that provides more choices, competition and convenience. The end result was a big win for consumers. It’s important to note—that with passage of the bill—every auto loan and every auto finance source will be regulated by the new Consumer Financial Protection Bureau.

As the incoming chairman for NADA, what are the areas you are going to focus on this year?

That’s an interesting question. Now don’t misunderstand me, but like my predecessors at NADA, I’m not sure I will have the luxury of a single focus when it comes to the nature of our business in Washington, D.C. We will have to stay on top of so many issues that could adversely affect new car and truck dealers.

I will provide a more detailed analysis of our key issues for 2011 during my speech at the NADA convention in San Francisco on Monday, February 7, so stay tuned.

But I can tell you, generally in 2011, NADA will work to support legislation and regulations that will help boost the economy, encourage auto sales, create jobs and reduce the regulatory burdens that could impair progress in these areas.

We will encourage members of Congress to decrease the regulatory burdens on auto dealers across the board, and work to dial back some “overreach” on issues over the past few years.

Even though dealer-assisted financing was excluded from the Dodd-Frank Wall Street reform bill, we recognize that greater regulation of indirect auto financing may be a reality. How the Dodd-Frank legislation will be implemented is of vital interest to us all. We need to ensure that there is appropriate congressional oversight on how the financial services legislation will be implemented.

Small businesses and dealers on Main Street need a rational tax structure with certainty. Uncertainty on taxes and regulatory overload will hurt Main Street business, hurt consumers and limit job creation.

On the industry relations front, a paramount issue for us is dealer profitability and the transfer of costs from the manufacturer to the dealer. We are absorbing more and more while waiting for the economy to stabilize.

As far as the debate on fuel economy, we will continue to push for rational and feasible greenhouse gas regulations at the national level.

(Editor’s note: NADA won a huge victory in the summer of 2010 when it successfully kept dealers from being included in the oversight from the new Consumer Financial Protection Bureau. There still is a lot of uncertainty with what the banks may require from dealers as a result of the bill.)

What about the fuel economy issues?

The debate over fuel economy is certainly heating up. We’re urging federal regulators to consider carefully how the rising cost of vehicles will affect consumers when federal fuel economy mandates are increased. NADA has long supported improvements in fuel economy, but while the debate rages on, it is also our role to ask some tough questions and figure out what will work in the marketplace.

The government is trying to push new fuel economy mandates so quickly, I’m afraid the American public is going to balk. Think about where customers are now. People want to buy my Escalades. They don’t want to buy my Priuses until gas is at $4-plus a gallon. The government can’t legislate people into vehicles they don’t want to buy. And that’s our challenge.

For many Americans, the prospect of being priced out of the car market means being driven out of the job market, so a primary concern for NADA is the affordability of basic transportation. Preventing further job losses, preserving consumer choice and affordability and improving safety should be primary factors in setting any fuel economy standard.

Which of these areas do you think are most challenging right now?

Well, I do know, right at the top are the regulatory and legislative issues. And right behind that are the challenges with the manufacturers and keeping them satisfied.

In addition to that, with the economic challenges we’ve experienced, many dealers continue to have problems with financing. General Motors and Chrysler appear to be financially stable right now. They’ve shed their debt, restructured and things are now improving. But some manufacturers are telling us we need to build new facilities.

The problem is that the dealer body hasn’t healed yet. We’re still trying to come out of this economic malaise. And with reduced profitability and more cost transfers, it’s very difficult for us. It’s forcing a lot of dealers to evaluate whether they want to be in this business.

We’re seeing it with so many manufacturers trying to dictate facilities upgrades right now – Lincoln, Mercedes, Hyundai, and even Chrysler. And with Fiat wanting separate facilities. Did you obtain a Fiat franchise?

No, I have Chrysler, though.

I’m not sure about Fiat. It’s a brand with a tough history trying to get into a segment whose sales have tanked.

I really don’t know much about Fiat, but I think Chrysler has an extremely bright future, even though most of us have been doomsayers on the brand. Sergio Marchionne is one of a kind. His style of management is what amazes me. It seems as though everybody reports to him. I don’t know how he does it.

What are you seeing with GM? They tried to rewrite the franchise agreements in 2009.

I have to give GM kudos here. There were a couple of serious meetings because of that. We met with them at NADA’s offices just after the bankruptcy and they had put together a dealer agreement we couldn’t live with. But I’ve got to tell you, they backed off that. They kept the agreement that was in place, and we appreciated it. You have to give credit where credit is due.

That was a good day for dealers, and gave me great respect for the new leadership at GM.

How did you get into the business?

I didn’t set out to be in the business. My father had a small finance company that provided floorplanning for used car dealers so I had a little exposure to it.

I started selling some in college for spending money, fraternity dues and dating expenses – stuff like that. One of my fraternity brothers, Robert Garff, of the Ken Garff Dealer Group, let me do some buying and selling while I was working on my master’s degree.

One day we were talking about Mazda as a franchise and they asked me to help him put together a franchise package, which I did. One thing led to another and they asked me to come run it, but I didn’t want to be in the car business. I wanted to be an attorney.

We went down to California and happened to visit a Mazda showroom in Santa Monica. A woman at the dealership with a microphone was inviting people to take a test drive. There were people in line to drive the new Mazda with a rotary engine.

We visited with the dealer and he told us to run to get a Mazda franchise if we had the opportunity. So I ended up getting involved. While in Japan picking up one of my brothers on a mission for our church, I took an inside look at Mazda and decided it had a future. So I came back and bought out the other dealer’s shares and was off and running. Now, it’s 20 franchises later.

You’ve had a good run.

I’ve really enjoyed the business. It’s been good for my family. I really love being a car dealer.

Why did you start getting involved with NADA?

In 2002, some dealers asked me to be their NADA representative. It was over lunch one day, and I’ll never forget this, they said, “You know Stephen, it won’t take that much time.”

I ended up on some great committees such as industry and government relations which helped me get involved right at the onset. Two years ago, at the NADA convention in New Orleans, John McEleney, then the chairman, asked me to chair an industry task force to help obtain credit for dealers, which at the time, was a big problem. I went right over that afternoon and we met with some folks from the captive finance firms. Over time, I thought I could help make a difference, so I ran for vice-chairman and I’ve certainly been up to my elbows with it since then.

If you think about it, NADA has won some hard fought battles on Capitol Hill with what we were able to accomplish with dealers’ rights and the Wall Street reform bill.

I’ve been able to travel this country and meet with dealers who operate businesses of all sizes. I stand in awe and admire them very much.

Dealers are a different lot. Most are really the backbone of their communities and drive the economy of our country.

Are you concerned that the smaller dealer might be more at risk today?

That’s a great question. You know, when the Internet came, we felt endangered. Then there were the public dealer groups – oh boy, there is the demise of the dealer. But dealers are such an important part of their communities. If they are given the same opportunities the big dealers are given, we will be fine.

But I’m fearful of some of these stair-step programs that create a two-tier system that favor bigger dealers. If smaller dealers are allowed to operate on a level playing field, we will be okay.

What about the financing? Is that a potential threat as it was a couple of years ago?

The good news today is that vehicle sales and access to credit are improving. Improving access to credit for both dealers and car shoppers is an issue we have worked on very closely over the past couple of years. Credit stability is an issue we will continue to monitor closely as we go forward.

What did you buy?

It was a dealership in Chico, Calif., with Cadillac, Buick, GMC, Mercedes, BMW, Volvo and Subaru franchises in a wonderful community. It’s a dealership with 85% absorption.

I just spoke at a conference in Dallas, and one of the other speakers had a graph showing how people will let their house payments go before their car payments. Banks are seeing that car paper is strong. As a result, subprime seems to be bouncing back. The problem continues to be real estate and mortgages.

You have five children. Are they involved in the business?

I have four boys and a daughter. My daughter is a stay at home mom with four children. All of my boys are involved in some facet of the business. The challenge is that I want them to be better at the business than their old dad.