Dealership real estate is an increasingly important factor in dealership valuation. Commercial real estate prices have risen significantly in recent years, and buyers are able to gain very attractive real estate financing in today’s market. As such, real estate is becoming a very important component in getting deals done in today’s buy-sell market. (For this reason, many buyers today will not do an acquisition if the real estate is not included in the transaction.)

Real estate valuations also directly affect the rent that dealers pay and, ultimately, the earnings of a dealership. The higher the real estate price, the higher the rent. Higher rent lowers earnings, and thus lowers blue sky value.

However, as outlined in a real world example detailed below, higher real estate values can increase the overall value of the transaction.

Interplay Between Dealership Real Estate and Blue Sky

I am often asked about the interplay between these important assets.

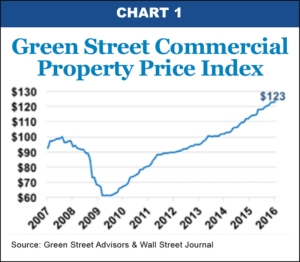

First, it is important to note that there has been a significant rise in commercial real estate values in the U.S. since the recession, as can be seen in Chart 1. In fact, real estate prices have risen far above pre-recession levels.

Most dealerships are sold with their real estate, and dealership real estate appraisals have come in markedly higher in the last 12 months. In some cases, the real estate represents the majority of the overall transaction price and eclipses the value of the blue sky.

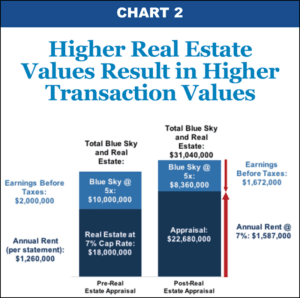

Generally speaking, when dealers own their real estate, they prefer more of the transaction value to go to real estate. This is because real estate trades at a much higher multiple (a 7% cap rate is equivalent to a 14x multiple) as compared to blue sky (~5x multiple). As such, all things being equal, shifting dollars from dealership profits to the rent expense line can result in significant value creation.

With real estate prices rising rapidly in recent years, what does this mean for dealers? The example in Chart 2 highlights the benefit of rising real estate prices to sellers. In this example, the seller’s real estate is appraised 26% higher than the value the dealer had been using to calculate his rent factor. As a result, we adjusted rent upward to account for the higher real estate value, holding the cap rate constant at 7%. This adjustment reduced the dealership’s earnings (and the blue sky value), however, the increased real estate value more than offset the reduced blue sky and resulted in a $3 million increase in overall transaction proceeds. In other words, higher real estate prices may reduce a dealership’s earnings and its blue sky value, but the higher real estate prices increased the overall transaction value.

Too Much of a Good Thing?

Of course, there is a limit as to how high real estate prices can rise before they create challenges for the business. Rent is generally fixed and cannot be adjusted as quickly as other expense lines. Thus, in downturns, high fixed costs, such as rent, can be a major impediment in downsizing costs and restoring profitability. Dealers should be aware of the tipping point at which real estate prices reach a level that is too high for a dealership to support. Many dealers learned this lesson the hard way during the recession after they had built expensive facilities that pushed dealerships’ capacity to cover the rent.

And, yes, real estate prices can be too high, and impede getting a transaction done. We recently worked with a dealer with a store in a high density, metro area, who had seen the value of his real estate climb dramatically in recent years. However, much of the value creation was due to the redevelopment of the surrounding area, pushing up the price of land. When we applied the rent tied to his most recent appraisal, the rent factor for this (very profitable) dealership was over 20% of gross profit. In this case, we advised that, IF a buyer was willing to pay appraised value for the real estate, we believed the accompanying blue sky multiple would be at the very low end of our valuation range. At some threshold, the risk of high rent will push down the market value of a dealership.

As a benchmark, the average dealership, according to NADA, has a rent factor that is ~1.2% of sales or 7% of gross profit. As a rule of thumb, dealers should strive for a rent factor that does not surpass 10% of total gross profit. Above this level, the blue sky multiple may decline due to the rent factor perceived to be too high, and thus reduce the overall transaction. This is not surprising because a high rent factor adds risk to an acquisition and may therefore reduce the multiple a buyer is willing to pay.

In summary, rising real estate prices have been a recent boon for dealers selling their dealerships and accompanying real estate. As long as prices do not rise beyond a level that the dealership can comfortably support, rising real estate prices materially benefit a dealer considering a sale.